Assessing Returns in the Specialty Chemical Industry

The proprietary products and processes developed by specialty chemical firms command a premium and have enabled companies to post high returns on capital.

March 7 2016, Updated 8:06 p.m. ET

Capital intensity

Capital-intensive industries have a high proportion of fixed costs. Therefore, in periods marked by substantial volume declines, these industries experience sharper profit declines than less capital-intensive industries. An abundance of capital worldwide has further depressed margins by fueling excess supply due to expansion projects carried out in more capital-intensive industries. The median net debt-to-equity level, for example, hovers at around 38% for specialty chemical firms. Architectural coating companies such as Valspar (VAL), Sherwin-Williams (SHW), and PPG Industries (PPG) are often more capital-intensive on account of the costs related to their expansive distribution networks.

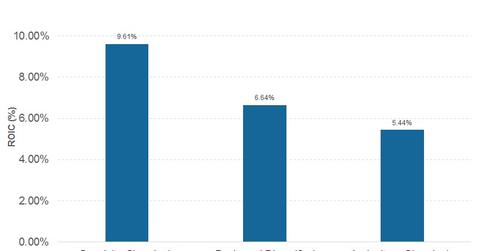

At the same time, the proprietary products and processes developed by specialty chemical companies command a premium and, therefore, have enabled these companies to post returns on capital that are almost twice the median returns for commodity chemical (VAW) companies. (Please note that the database compiled for this analysis includes only publicly listed companies that are domiciled in the US. A company is classified as a specialty chemicals company only if more than 50% of annual revenues came from specialty chemicals.)

Additionally, several companies are carrying out profit-pool mapping to figure out the right places to stay in business and where to exit less profitable business segments. This is reflected in the efficient utilization of assets, with the industry generating about $0.97 in revenue using a dollar in assets. Notably, the median asset turnover ratio for specialty chemical companies was 0.97 in 2015, which is higher than the commodity chemical (XLB) median asset turnover of 0.84 over the same period.

Why ROIC?

ROIC (return on invested capital) is often considered a superior profitability metric because it removes leverage related distortions that can make a company look more profitable than it actually is. ROIC is also different in that measures total operating profits after taxes but excludes interest expenses, which is the total amount of money returned to all sources of capital. Lastly, ROIC is also useful in screening companies with exclusive competitive advantages, since such companies are often high ROIC machines with well-established market positions.

Why specialty chemicals have high ROICs?

As seen below, the median ROIC for specialty chemical industries is almost twice that of commodity chemical firms, and these ROIC figures reflect the different strategies followed by these respective industries. While commodity companies sell their products based on cost leadership, specialty firms sell differentiated products to their customers.

That said, these chemicals are often a small portion of the overall cost of production of goods in end markets. Therefore, there are significant switching costs once a product is specified, enabling specialty chemical firms to sell their products at a premium.

Now let’s analyze business models.