Advertising is key for automotive companies

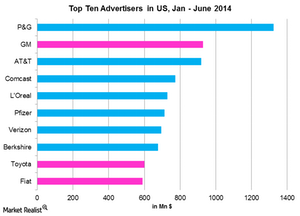

The automotive industry is one of the biggest spenders when it comes to advertising. General Motors (GM) paid out $928 million during the first half of 2014.

Feb. 11 2015, Updated 11:05 a.m. ET

Promotional spending

The automotive industry is one of the biggest spenders when it comes to advertising. General Motors (GM) paid out $928 million during the first half of 2014. In 2013, General Motor’s global advertising expenditure was $5.5 billion. It represented 3.54% of its revenue.

In 2013, Ford (F) spent $4.4 billion for automotive revenue of $139.37 billion. The same year, Fiat Chrysler (FCAU) spent $2.76 billion. It represented 3.82% of its revenue.

Toyota (TM) has become one of the top ten biggest advertising spenders in the US. The company spent $600 million during the first half of 2014. Fiat spent $589 million during the same period. It’s the third automaker on the list of the top ten advertisers in the US.

The First Trust NASDAQ Global Auto ETF (CARZ) gives investors direct exposure to vehicle manufacturers.

The key to survival in the automotive sector

The automotive industry is the world’s third largest industry in terms of research and development, or R&D, spending. In 2013, Toyota Motors spent $8.1 billion on R&D. General Motors spent $7.2 billion that year. For Toyota, spending a lot on research helps keep the competition at bay.

Automakers are consistently being challenged to make faster, smarter, and more efficient vehicles. So, innovation has taken center stage. A typical high-end car has about 70–100 microprocessors executing more than 100 million lines of code. Compare this to a Boeing 787 that has a computer that executes just 6 million lines of code.

Manufacturing cars is a complex business. It can take several years to develop a vehicle. The new Ford F-150 took about five years to complete. Its roll out will take place in January 2015.

The auto industry spent more than $100 billion globally in 2013—including $18 billion in the US. According to Strategy&—formerly Booz & Company—99% of the industry’s R&D spending comes from the industry itself. The federal government only contributes 1% of the auto industry’s R&D spending—less than the government gives to any other industry.

The auto industry is reaping rich benefits from investing in fuel efficiency improvements. We’ll discuss this in the next part of this series.