Why Rent Is Going through the Roof

As more and more people seek apartments, rent has also been rising rapidly. In fact, rent has been rising faster than the overall cost of living in the US.

Feb. 1 2016, Published 2:42 p.m. ET

Series overview

In a previous series, US Home Prices: Will the Growth Momentum Continue in 2016, we discussed how rising home prices have led to unaffordable housing for median income households. In this series, we will discuss rising rent and its impact on households.

Driving factors

The progression of the knowledge economy during the past two decades has attracted young talent from all over the world to the major US growth centers. In addition to these factors, the natural growth of the population has increased demand for real estate in most cities. As the demand for property rises, home prices increase rapidly, making houses unaffordable for many. The lower inventory on the market further aggravated the situation, putting houses beyond the reach of buyers. As a result, prospective homeowners have no other option but to live in rented apartments.

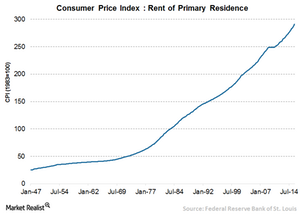

As more and more people seek apartments, rent has also been rising rapidly. In fact, rent has been rising faster than the overall cost of living in the US. The graph of the consumer price index (or CPI) for all urban consumers shows the sharp rise in the rental segment after 2011. According to Axiometrics, a Dallas-based apartment research company, apartment rent rose 4.7% in 4Q15 over 4Q14. This was the strongest fourth quarter rise since 2005.

Apartment REITs to benefit

The rising demand for rented properties bodes well for apartment REITs, which earn income by renting residential properties to tenants. Investors can get exposure in the apartment REIT sector by investing in the iShares Cohen & Steers REIT ETF (ICF). Apartment REITs like Equity Residential (EQR), AvalonBay Communities (AVB), Essex Property Trust (ESS), and UDR (UDR) make up 6.7%, 5.5%, 3.4%, and 2.2% of ICF’s portfolio, respectively.

Continue to the next part of the series for a discussion on rental growth in regional markets.