How Offshore and Onshore Drilling Perform when Oil Prices Tumble

Unconventional sources of onshore drilling have started gaining popularity in recent years, but the crude from these sources are costly to produce.

Feb. 4 2016, Updated 10:06 a.m. ET

Conventional versus unconventional sources

Oil drilling is mainly classified into two categories: offshore and onshore. But the industry can also be classified as conventional or unconventional. Unconventional sources of oil do not flow to the surface, as the conventional sources do, and the former sources need different methods of extraction. Onshore unconventional oil sources include heavy oils, oil sands, shale oil, and tight sand. These unconventional sources have started gaining popularity in recent years, but the crude from these sources are more costly to produce than conventional sources are.

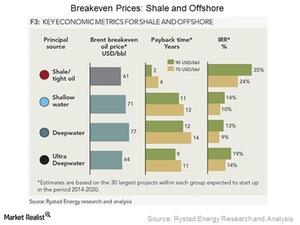

Comparing costs: onshore versus offshore

Traditional onshore drilling is cheaper than offshore drilling, but the overall cost of unconventional onshore oil is on par with or exceeds offshore drilling costs. These costs also differ according to the region of oil production. For example, the lowest breakeven cost is $25 per barrel for onshore oil production in the Middle East (According to Rystad Energy Research). Due to lower breakeven costs for onshore compared to offshore drilling, these companies tend to perform better when oil prices tumble. Offshore drilling companies include Diamond Offshore (DO), Rowan Companies (RDC), Pacific Drilling (PACD), Ocean Rig (ORIG), and Transocean (RIG), among others.

Capex of E&P companies

Global Oil Company’s capex, to use one example, has climbed rapidly over the past few years. According to industry analysts, the approximate investment for offshore drilling in 2005 was around $150 billion, but this figure jumped to $360 billion till 2014. This increase in capex was due to increases in oil consumption as well as to the rising demand for offshore production and to inflation. As oil prices decline, oil company’s profits decline, and this cuts its upstream capex budget.

Falling oil prices more adversely impact the onshore drilling industry as offshore drilling (XLE) contracts and investments have longer lead time. Capital budgets for shale decline the most when oil prices are tumbling, but shale-producing companies are more flexible to short-term price collapses. Operators can drop shale rigs more quickly than they can with offshore rigs. But once oil prices rebound, shale will likely be the fastest to recover. That said, investments in shale have the lowest payback period and the highest internal rate of return.

Continue to the next part for a deeper discussion of high leverage among offshore drilling companies.