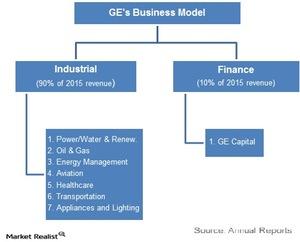

Graphical Representation of General Electric’s Business Model

General Electric’s industrials and finance services are its two broader divisions, contributing 91% and 9%, respectively, to its consolidated 2015 earnings.

Nov. 20 2020, Updated 2:59 p.m. ET

GE’s business at a glance

General Electric Company’s (GE) industrials and finance services represent its two broader divisions, contributing 91% and 9%, respectively, to the company’s consolidated earnings in fiscal 2015. Operating margins for the industrial segment was 17% while the net interest margin of the finance division is ~5%. There are seven sub-segments under industrial while the financial (XLF) operating segment is known as GE Capital. The graph below clarifies GE’s business model.

*Note: GE has sold its appliance division to Haier.

GE’s industrial backlog and geographic reach

GE’s order backlog can be classified in two categories: servicing and sales of equipment. For the industrial (XLI) segment, the order backlog from servicing is 71.7%, or $226 billion, while the order backlog from sales of equipment was at 28.3%, or $89.3 billion.

According to the 2010 annual report, GE’s total revenues from the US was at 46%, while in 2014 the company’s revenue from the US stood at 48%, compared to Europe at 17%, Asia at 16%, 9% from Americas, and the remaining 10% from the Middle East and Africa.

GE’s core strength and competitiveness

General Electric (GE) stands out among other large conglomerates on the back of both innovative technology and industrial depth. GE is unique in terms of the following:

- wins with technology

- wins in growth markets

- wins with services

The above value across the globe will be targeted in the following ways:

- keeping a lean management with most decisions distributed

- speedily competing and achieving by undertaking smaller things and adopting fast works like Lean and Six Sigma

- tapping commercial intensity by way of seamless market alignment globally, value for customers, and providing more horizontal solutions

In all cases, digital capabilities are the need of the hour, and a new talent base with a new skill set could make GE as the smartest and most efficient company in the world.

Operating EPS target for 2016

GE is part of the Industrial Select Sector SPDR ETF (XLI) and accounts for 11.78% of XLI’s total holdings. GE is also one of the top ten holdings of the Vanguard High Dividend Yield ETF (VYM), accounting for 3.6% of VYM’s total holdings. Microsoft (MSFT) and Exxon Mobil (XOM) are among the top holdings in the fund.

In leveraging its core strengths and competitiveness, GE is aiming for a 75% operating EPS target from industrials for 2016. Now let’s take a tour of GE’s eight segments for a better understanding of GE’s business model.