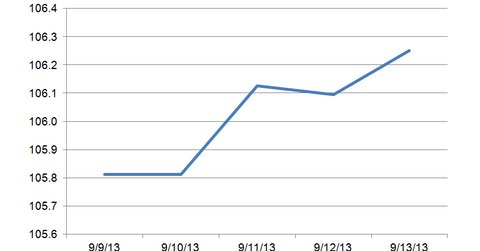

Ginnie Mae TBAs rally before the Fed meeting

Mortgage-backed securities are the starting point for all mortgage market pricing and the investment of choice for mortgage REITs When the Federal Reserve talks about buying mortgage-backed securities, it’s referring to the To-Be-Announced (also know as the TBA) market. The TBA market allows loan originators to take individual loans and turn them into a homogeneous product […]

Nov. 20 2020, Updated 5:15 p.m. ET

Mortgage-backed securities are the starting point for all mortgage market pricing and the investment of choice for mortgage REITs

When the Federal Reserve talks about buying mortgage-backed securities, it’s referring to the To-Be-Announced (also know as the TBA) market. The TBA market allows loan originators to take individual loans and turn them into a homogeneous product that can be traded. TBAs settle once a month, and government mortgages (primarily FHA/VA loans) are put into Ginnie Mae securities. TBAs are broken out by coupon rate and settlement date. In the chart below, we’re looking at the Ginnie Mae 4.5% coupon for October.

Loan originators base loan prices on the TBA market. When they offer you a loan (as a borrower), your rate is par, give or take any points you’re paying. Your originator will then sell your loan into a TBA. If you’re quoted a 4% mortgage rate with no points, the lender will fund your loan and then sell it for the current TBA price. In this case, the TBA closed at 106 8/32, which means your lender will make just about 6% before taking into account their cost of making the loan. The 4.5% is considered a “cuspy coupon” which means if rates fall slightly, the 4% will return to being the base coupon for government loans

The Fed is the biggest buyer of TBA paper. Other buyers include sovereign wealth funds, countries that have trade surpluses with the United States, and pension funds. TBAs are a completely “upstairs” market in that they don’t trade on an exchange and most of their trading is done “on the wire” or over the phone.

The market sits on its hands ahead of the FOMC meeting

After last Friday’s jobs report, there wasn’t much market-moving data last week. The TBA market is focused on how the Fed will taper quantitative easing. So far, it’s looking like the Fed will start reducing purchases this month but it will concentrate on Treasuries, not MBS (mortgage-backed securities). This is a net positive for mortgage REITs.

Implications for mortgage REITs

Mortgage REITs—such as Annaly Capital (NLY), American Capital (AGNC), MFA Financial (MFA), Capstead Mortgage (CMO), and Hatteras Financial (HTS)—announced big drops in book value per share, as rising rates hurt the value of their mortgage-backed security holdings. The REIT sector has been de-leveraging in order to take risk off the table.

As a general rule, a lack of volatility is good for mortgage REITs because they hedge some of their interest rate risk. Increasing volatility in interest rates increases the cost of hedging. This is because as interest rates rise, the expected maturity of the bond increases, as there will be fewer pre-payments. On the other hand, if interest rates fall, the maturity shortens due to higher pre-payment risks. Mechanically, this means mortgage REITs must adjust their hedges and buy more protection when prices are high and sell more protection when prices are low. This “buy-high, sell low” effect is called “negative convexity,” and it explains why Ginnie Mae MBS yield so much more than Treasuries that have identical credit risk (which is to say none).