Canadian National Railway: Class I Railroad with a Robust Network

A Class I railroad in the US, or a Class I railway in Canada, is one of the largest freight railroads based on operating revenue. US Class I Railroads are line haul freight railroads with 2014 operating revenues of ~$475.75 million.

Feb. 25 2016, Published 12:11 p.m. ET

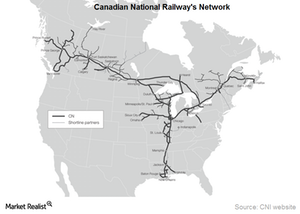

Canadian National’s network

Earlier, we discussed the privatization of the Canadian National Railway (CNI) by the Canadian government. Let’s take a look at the company’s rail network. CNI’s network of approximately 19,600 miles covers major ports such as the Ports of Vancouver and Prince Rupert in British Columbia, Montreal, and Halifax. CNI has the sole access to the Port of Prince Rupert.

American ports include New Orleans, Louisiana, and Mobile, Alabama. The company also reaches the metropolitan areas of Toronto, Edmonton, Winnipeg, and Calgary. American destinations include Chicago, Illinois; Memphis, Tennessee; Detroit, Michigan; Duluth, Minnesota; Superior, Wisconsin; and Jackson, Mississippi.

Short lines also strengthen Canadian National’s total coverage. As of February 20, 2016, the company had access to 70 short-line partners in the US and Canada. A short line is a rail network in locations where Class I railroads don’t have tracks laid.

Class I railroad

A Class I railroad in the US, or a Class I railway (or a Class I rail carrier) in Canada, is one of the largest freight railroads based on operating revenue. According to the Association of American Railroads, US Class I Railroads are line haul freight railroads with 2014 operating revenues of ~$475.75 million. These are:

- BNSF Railway

- CSX Transportation (CSX)

- Grand Trunk Corporation (CNI)

- Kansas City Southern Railway, smallest Class I by revenue

- Norfolk Southern Combined Railroad Subsidiaries (NSC)

- Soo Line Corporation (CP)

- Union Pacific Railroad (UNP)

The peer group excluding CP, CNI, and BNSF Railway forms part of the Guggenheim S&P 500 Equal Weight ETF (RSP).

Competition

Canadian National (CNI) faces competition from marine, trucking, and other railroad companies. The segment, price, and reliability of service are the main considerations in assessing CNI’s competition. Canadian Pacific Railway (CP) is Canadian National’s main freight railroad rival, as it operates in similar geography in Canada and serves most of the same industrial areas and population centers.

In the intermodal segment, CNI also faces competition from truckload companies such as J.B. Hunt Transport (JBHT), Heartland Express (HTLD), Swift Transportation (SWFT), and Landstar System (LSTR).

Canadian National derives freight revenues from seven commodity groups. The company is the originating carrier for approximately 85% of traffic moving along its network. In addition, nearly 70% of CNI’s traffic originates and terminates on its network.

Next, we will see how Canadian National is positioned in the Porter’s Five Forces model.