What’s Driving Broadcom’s Revenue?

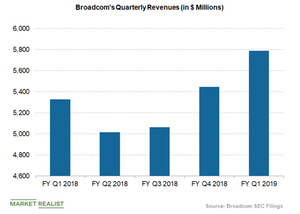

Semiconductor giant Broadcom (AVGO) achieved quarterly revenue of nearly $5.79 billion in the first quarter fiscal 2019.

March 19 2019, Published 8:34 a.m. ET

Broadcom’s revenue in the first quarter

Semiconductor giant Broadcom (AVGO) achieved quarterly revenue of nearly $5.79 billion in the first quarter fiscal 2019, up 8.7% YoY (year-over-year) from the previous year’s quarter. Its revenue, however, failed to meet analysts’ expectation of $5.82 billion.

In the first quarter, Broadcom changed its reporting units to two main segments—Semiconductor Solutions and Infrastructure Software—as well as a small intellectual property licensing unit.

Revenue drivers by segment

Broadcom earned substantial revenue from the Infrastructure Software segment, which surged 328% YoY to $1.4 billion, in the first quarter. The significant growth in its revenue was driven by its acquisition of mainframe software company CA Technologies. Broadcom announced the CA acquisition in July 2018, after US President Donald Trump terminated its plan to acquire Qualcomm (QCOM) on March 12.

However, its intellectual property licensing revenue also fell 73% to $12 million in the first quarter.

The Semiconductor Solutions segment’s revenue fell 12% YoY to $4.37 billion due to a sharp fall in wireless revenue. Excluding wireless, the Semiconductor Solutions segment grew YoY. The strong performance in the networking business driven by higher sales of optical components to cloud companies helped the company earn revenues in the Semiconductor Solutions segment.

Broadcom’s wireless revenue was dented by a slowdown in China (MCHI) (FXI), weakness in Apple’s iPhones, and the resulting loss of orders of radio frequency chips faced by Apple suppliers, including Qorvo (QRVO). Like Broadcom, NVIDIA (NVDA), Apple, Micron (MU), and rival chip maker Intel (INTC) have also suffered from declining demand in China. Intel reported soft results in the fourth quarter of 2018 and gave weak guidance for 2019, mainly due to sluggish demand in China. Micron gets ~50% of its revenue from China.

Outlook

For fiscal 2019, Broadcom’s revenue is expected to be ~$24.5 billion, including $19.5 billion from Semiconductor Solutions and ~$5 billion from Infrastructure Software. Intellectual property licensing isn’t likely to generate any significant revenue in the year.