Analyzing Southern Company’s Debt Profile

As of September 30, 2015, Southern Company had total debt of $27 billion against equity of $20.6 billion. Of this, $22.3 billion is long-term debt.

Jan. 28 2016, Updated 7:04 p.m. ET

SO’s debt profile

Southern Company (SO) has a ~$13 billion capital spending plan for the next two years. This will be mainly funded by long-term debt financing.

As of September 30, 2015, SO had total debt of $27 billion against equity of $20.6 billion. Of this total debt, $22.3 billion is long-term debt. SO has a debt-to-equity ratio of 1.3x and a debt-to-capitalization ratio of 0.6x.

Leverage

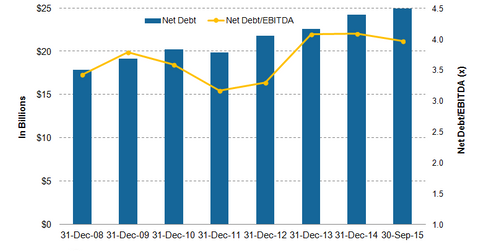

Southern Company has a net debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) ratio of 3.9x, which is equal to Duke Energy’s (DUK) 3.9x. Peer NextEra Energy (NEE) has a net debt-to-EBITDA ratio of 3.4x. The net debt-to-EBITDA ratio shows how many years it will take a company to repay its debt using EBITDA if debt and EBITDA remain constant.

Utilities is an asset-rich business and involves heavy amounts of debt. Hence, leverage is an important metric in analyzing utilities. The debt-to-asset ratio represents the proportion of a company’s assets that are financed by debt. It assesses the financial risk of a company.

SO has a debt-to-asset ratio of 0.3x, which is again equal to Duke Energy’s ratio. NextEra Energy (NEE) also has a debt-to-asset ratio of 0.3x.

Credit rating

In August 2015, Standard & Poor’s (or S&P) Financial Services revised its outlook for SO from “stable” to “negative,” with a credit rating of “A-.” This revision took place due to cost overruns at the company’s Vogtle nuclear plant and the additional debt burden of the AGL Resources acquisition.

S&P is a renowned credit rating agency that assesses and rates companies based on their financials. By comparison, S&P has given Exelon (EXC) a credit rating of “BBB” and a “stable” outlook. At the end of fiscal 3Q15, the utility sector’s (XLU) average credit rating remained at “BBB+.”