What Are Analysts’ Recommendations for Noble Energy?

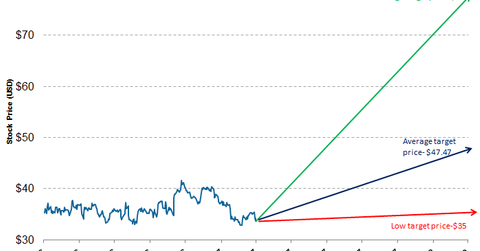

Approximately 53% of the analysts rate Noble Energy (NBL) as a “buy” and 32.3% rate it as a “hold.” The average broker target price is $47.47.

April 21 2017, Updated 4:35 p.m. ET

Consensus rating for Noble Energy

Approximately 53% of the analysts rate Noble Energy (NBL) as a “buy” and 32.3% rate it as a “hold.” The average broker target price of $47.47 implies a return of ~39% in the next 12 months.

Analysts’ target prices

Analysts’ high and low target prices for Noble Energy are $77 and $35, respectively. Noble Energy is part of the SPDR S&P North American Natural Resources ETF (NANR). NANR invests 0.75% of its portfolio in Noble Energy.

Recent upgrades and downgrades

On January 17, 2017, Seaport Global Securities upgraded its rating for Noble Energy from “sell” to “neutral.” In December 2016, the company downgraded its rating from “neutral” to “sell.”