What Do Analysts Recommend for Ford ahead of 4Q15 Results?

Ford Motor Company (F) will release its 4Q15 earnings report on January 28, 2016. Nearly 43% of total analysts covering Ford have given it a “buy” recommendation.

Jan. 22 2016, Published 2:14 p.m. ET

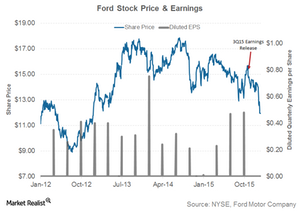

Ford’s stock prices fell

Ford Motor Company (F) will release its 4Q15 earnings report on January 28, 2016. In this series, we’ll discuss analyst estimates that will help investors better understand the upcoming earnings report. First, let’s find out how Ford stock prices traded in 2015.

Despite posting a sharp rise in 3Q15 profits, Ford missed Wall Street estimates, which triggered a sell-off in the company’s stock. As of January 19, 2016, the company’s stock registered a sharp fall of more than 15% year-to-date (or YTD). This fall can be attributed to a broader market sell-off (XLY) along with investors’ fear that US auto sales might have already peaked.

Analyst recommendations

According to the Bloomberg consensus, nearly 43% of total analysts covering Ford have given it a “buy” recommendation while the other 52.4% of analysts recommended a “hold.” Only one analyst expects the company’s stock price to remain weak and has given a “sell” recommendation. Wall Street analysts are maintaining a neutral view on Ford due to the production constraints that the company had been facing lately along with the company’s worsening performance in the Chinese market, which we’ll talk about later in this series.

Investors should pay attention to analyst recommendations, as they may affect the company’s stock price movement. Changes from a popular analyst can cause a significant short-term movement in the stock price.

Target prices

As of January 18, 2016, Ford’s consensus 12-month target price is $17.12 with a 43% return potential from the current market price of $11.97. Colin Langan of UBS has the highest price target of $22 for Ford, which may yield an 83.8% return for investors. The analyst remained positive about the company throughout the year because of its ability to maintain high margins despite lower sales in its F-series. Dan Galves of Credit Suisse doesn’t expect any significant price move with a target of $15 due to increasing warranty costs and weak truck production.

Peer comparison

Among Ford’s peers, most of Wall Street analysts are bullish on Toyota. Analyst consensus for Ford’s peers in regards to their 12-month return potential are as follows:

- Toyota (TM): 66.7% of the analysts have given it a “buy” with a 28% return potential

- General Motors (GM): 57.1% of the analysts have given it a “buy” with a 41.3% return potential

- Fiat Chrysler Automobiles (FCAU): 51.7% of the analysts have given it a “buy” with 48.4% return potential

- Tesla Motors (TSLA): 40.9% analysts have given it a “buy” with a 45.1% return potential