JCPenney: Why Most Analysts Rate the Stock a ‘Buy’

As we mentioned in Part 1 of this series, JCPenney’s (JCP) stock has risen 24.7% since the start of the year to $8.69 as of June 28.

Nov. 20 2020, Updated 1:14 p.m. ET

12-month price target

As we mentioned in Part 1 of this series, JCPenney’s (JCP) stock has risen 24.7% since the start of the year to $8.69 as of June 28. In contrast, the stock prices of JCPenney’s department store peers Macy’s (M), Kohl’s (KSS), and Nordstrom (JWN) have fallen 9.4%, 24.1%, and 26%, respectively, since the start of 2016.

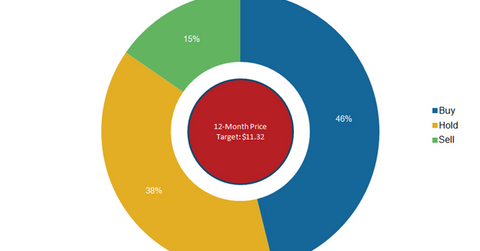

As of June 28, the 12-month price target for JCPenney’s stock was $11.32, which reflects a 30.3% upside potential.

Analyst recommendations

As of June 28, 46% or 12 out of 26 analysts had a “buy” recommendation for JCPenney’s stock. Ten analysts had a “hold” recommendation and four analysts had a “sell” recommendation. JCPenney’s buy rating is supported by the improvement in the company’s bottom line. JCPenney has been able to trim down its losses in each of the quarters of fiscal 2015 and also in 1Q16. The company continues to implement several measures to drive its sales growth, including merchandise enhancement, expanding its Sephora beauty business, focusing on its home business, and improving center core categories.

However, a challenging retail environment posed a hurdle to JCPenney’s turnaround, and the company reported a 1.6% decline in its 1Q16 sales after five straight quarters of sales growth.

Turnaround amid tough retail conditions

Uncertain retail conditions and a volatile macro environment cast a shadow on the performance of department stores. Intense competition from online retailers like Amazon (AMZN) and off-price retailers like TJX Companies (TJX) and Ross Stores (ROST) has hit department stores badly. In fiscal 2015, which ended January 30, 2016, Macy’s reported a sales decline of 3.7% while Kohl’s and Nordstrom reported sales growth of 1% and 6.9%, respectively. Nordstrom’s fiscal 2015 sales growth was mainly due to its off-price Rack stores and online channels. JCPenney reported sales growth of 3% in fiscal 2015.

JCPenney, Macy’s, and Kohl’s together constitute 0.6% of the iShares Russell Mid-Cap Value ETF (IWS).

JCPenney is optimistic about delivering its financial goals even in a tough retail market. Currently, analysts expect JCPenney to report sales growth of 1.4% in fiscal 2016. Analysts also expect JCPenney to report adjusted EPS (earnings per share) of $0.06 in fiscal 2016 compared to an adjusted loss per share of $1.03 per share in fiscal 2015.

For more updates, visit our Department Stores page.