Will the Merger Have Geographical Synergy for the New Company?

After the merger, the merged entity is expected to have a better geographical presence than its individual global presence.

Dec. 15 2015, Updated 10:06 a.m. ET

Dow and DuPont’s global presence

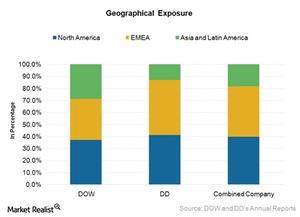

Dow Chemical (DOW) has a presence across the world. It’s almost equally diversified. In financial year 2014, Dow Chemical generated 37% of its revenue from North America—33% from the US and 4% from Canada. It generated 34% from the EMEA (Europe, Middle East, and Africa) region. The remaining 29% came from Asia-Pacific and Latin America.

DuPont (DD) has a relatively larger presence in the EMEA region. It had a total revenue contribution of around 46% in 2014. It had 41% from North America and 13% from Asia-Pacific and Latin America. Overall, Dow has a greater presence in the emerging markets, like Asia, than DuPont.

Geographical synergy

After the merger, the merged entity is expected to have a better geographical presence than its individual global presence. With respect to Dow Chemical and DuPont’s 2014 revenue, the combined entity would generate around 40% from the domestic market in North America, followed by 42% from EMEA. Its contribution from Asia and Latin America would increase by 18%.

With an increased presence and a focused portfolio approach, the merged entity would have the potential to capture growth in Asia and enhance its market position in Europe. With a stronger presence in Europe and research and development activities, the merged entity would be able to compete better with its large European peers like BASF, Syngenta (SYT), and others. However, the merged entity would continue to generate ~60% of its revenue from the international markets. As a result, the company’s earnings would be sensitive to currency fluctuation risks.

Peer’s geographical presence comparison

The merged entity would generate around 60% of its revenue from the international market. Its closest peers, Monsanto (MON) and Lyondell Basell (LYB), would have a higher domestic presence than the merged entity. It generated relatively smaller sales of 46% and 48%, respectively, from the international markets in 2014.

If the merger goes through, it will have a significant impact on the global chemical industry. Other chemical players will also look for merger and acquisition targets to enhance their market positions to compete with these global players. This could start consolidation in the chemical industry.

The Materials Select Sector SPDR ETF (XLB) is the largest chemical ETF. It tracks the performance of chemical players. Dow Chemical and Dupont account for 22% of XLB’s total holdings.