Sizing up Medtronic-Covidien, the Biggest Deal in the Medical Device Industry

On January 26, Medtronic completed the acquisition of Covidien for $42.9 billion in cash and Medtronic stocks and assumed Covidien’s debt of ~$5 billion.

March 31 2016, Updated 1:42 a.m. ET

Structure of the Medtronic-Covidien deal

On January 26, 2015, Medtronic (MDT) completed the acquisition of Covidien for $42.9 billion in cash and Medtronic stocks. Additionally, Medtronic assumed Covidien’s debt of approximately $5 billion. Investors received ~$35.2 per Covidien share and ~0.96 shares of the new entity—a combined value of ~$93.2 per Covidien share—which represented a 29% premium to Covidien’s closing stock price on the last trading day prior to the announcement.

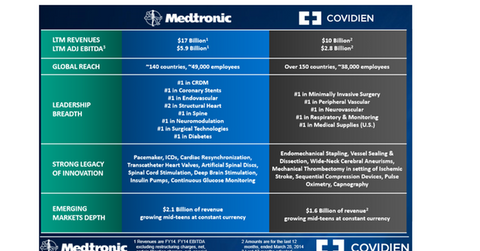

The diagram below offers some of the most significant details about Medtronic and Covidien as standalone entities prior to the acquisition.

The deal provided significant value to Covidien shareholders, representing approximately 30% of the ownership, by providing them with the opportunity to participate in the growth of the combined company.

Strategic benefits and opportunities of the deal

Medtronic has put forth the following three core strategies as its primary business drivers:

- therapy innovation

- globalization

- economic value

Covidien’s acquisition has so far helped Medtronic accelerate all three of these strategic priorities and consequently the growth of the company. The acquisition of Covidien has also helped advance Medtronic’s therapy innovation strategy through its complementary product portfolio, greater breadth across clinical areas, and new therapies.

The extensive manufacturing and R&D (research and development) capabilities of Covidien in emerging markets also presents an attractive opportunity for Medtronic to expand its geographic reach. The diagram below depicts the emerging market geographic mix for Medtronic after the acquisition of Covidien, compared to the fiscal 2014 geographic profile of the company prior to the acquisition.

The acquisition of Covidien upheld Medtronic’s strategic goal of creating economic value as its hospital efficiency technology would enhance Medtronic’s ability to create integrated health solutions, providing increased healthcare access, efficiency, and reduced costs.

Financial impact of the deal

Medtronic acquired Covidien in a tax-inversion deal, which means that it was an acquisition wherein the acquirer buys a company domiciled in another country, with more attractive corporate tax rates, and thus becomes a subsidiary of a new parent company in that country in order to reduce their total tax rate. As a result, Medtronic will have access to easier and cheaper cash outside the US.

The Medtronic-Covidien deal is expected to result in pre-tax cost synergies of $850 million by the end of fiscal 2018. These synergies include manufacturing and supply chain infrastructure optimization, administrative office optimization, and general and administrative savings.

Other players and ETFs

Other major players entering into big acquisitions in the US medical device industry include Zimmer Biomet Holdings (ZBH), Becton Dickinson and Company (BDX), and Stryker Corporation (SYK).

The SPDR S&P 500 ETF (SPY) is one of the largest ETFs providing diversified exposure to investors. SPY has an allocation of approximately 0.58% to Medtronic.

Continue to the next part of the series for a crucial look at Medtronic’s research and development pipeline.