Why Is Reserve Replacement Ratio Important to the Upstream Sector?

RRR reflects how many barrels of oil equivalent the company adds to its reserves in replacement of ones that are produced.

Dec. 8 2015, Updated 1:06 p.m. ET

Indicators of upstream health

So far in this series we have discussed the upstream sector dynamics based on crude oil prices and proved reserves distribution worldwide. In this part, we will drill down further to understand the upstream segment’s critical health checkpoints, namely inventory of reserves and RRR (reserve replacement ratio).

Energy companies’ inventory of reserves

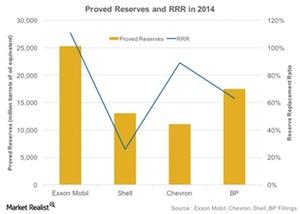

The above chart represents the proved reserves and RRR of integrated energy companies in 2014. Exxon Mobil (XOM) has the highest reserves of 25 billion boe (barrels of oil equivalent) followed by BP (BP), which has ~17 billion boe of reserves. These giants have enormous reserves at their disposal to convert into revenues and profits for the coming years.

The year-end reserves for Royal Dutch Shell (RDS.A) stand at ~13 billion boe, and Chevron’s (CVX) revenues stand at ~11 billion boe. Another point to consider for upstream companies is the number of years the reserves would last if no new reserves were added. If we assume 2014 production rates, XOM has reserves that should last for 17 years.

Significance of RRR for the energy sector

Exxon Mobil (XOM) had RRR of 111% in 2014. RRR for Shell (RDS.A) stood at 26%, Chevron’s (CVX) stood at 89%, and BP’s (BP) stood at 63% in 2014. RRR reflects how many barrels of oil equivalent the company adds to its reserves in replacement of reserves that are produced. An RRR of 100% suggests that a firm has added reserves equal to those produced in a given period.

However, it is worrisome when the ratio is below 100%, as it shows that firms are depleting reserves at a faster rate than production. In the future, this could lead to a fall in volumes and revenues for energy companies.

The Energy Select Sector SPDR Fund (XLE) has ~30% exposure to Exxon Mobil (XOM) and Chevron (CVX). In the next part, we will look at cost components for the upstream segment.