Fed’s Rate Hike Decision to Drive the Markets

In the wake of disappointing economic indicators over the past month, the Federal Reserve kept the interest rate unchanged in its policy meeting this week.

Sept. 26 2016, Published 3:25 p.m. ET

Skittishness has increased in September over a potential hike in U.S. interest rates, especially ahead of next week’s (9/20-9/21) FOMC meeting. In August (the month covered in this post), these concerns were mostly in the background. The ongoing search for yield continues to bring investors into emerging markets debt. Our view is that a rate hike by the Federal Reserve (the “Fed”) is not likely to dampen this trend, and that the environment for emerging markets debt will remain supportive.

All Eyes on the Fed

Investors focused on the Fed’s annual event in Jackson Hole, Wyoming (held in late August) for clues about the likely path of interest rates. A surprisingly strong July jobs report led to increasing expectations of a rate hike before the end of the year, and comments from Yellen and Fed Vice Chairman Stanley Fischer seemed to support that case. However, following the meeting weaker than expected U.S. manufacturing and August employment figures seem to have convinced the market that an imminent rate hike is now less likely.

Despite this rate uncertainty, flows into emerging markets debt remained strong in August, slightly moderating from the previous month. Globally, $8.0 billion flowed into emerging markets debt funds according to J.P. Morgan, bringing year-to-date flows to $31.3 billion, with $29.0 billion going into hard currency debt.

Market Realist – Emerging market debt continues to see higher demand

In the wake of disappointing economic indicators over the past month, the Federal Reserve kept the interest rate unchanged in its policy meeting this week.

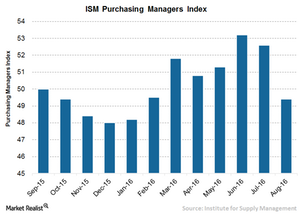

The Institute for Supply Management’s Manufacturing PMI (purchasing managers’ index) fell from 52.6 in July 2016 to 49.4 in August, much lower than the market’s expectation of 52. This was the index’s lowest level since February, and it was well below the average level of 52.8 since 1948. The fall was mainly triggered by falls in new orders, production, and employment.

Strong economic rebound unlikely

Consumption slowdown is another challenge affecting broader economic recovery. Data from the Commerce Department showed that retail sales fell 0.3% in August to $456.3 billion, the first fall in six months.

Similarly, jobs growth in August slowed sharply to 151,000 compared to 275,000 in July—much lower than the market’s expectation of 180,000.

As US economic growth (SPY) averaged a mere 1% in 1H16, hopes of a strong rebound in 2H16 have diminished due to disappointing economic data. As a result, the Fed had no other option than to delay its potential rate hike to December.

Emerging market debt

Despite the earlier uncertainty surrounding a potential rate hike this month, emerging market bonds (EMLC) (HYEM) saw rising demand driven by higher yields in an environment where yields have hit rock bottom.

Higher inflows are associated with a sharp spike in trading volumes. According to the Emerging Markets Traders Association, trading volumes in emerging market debt (EMB) (PCY) rose 12% year-over-year to $1.4 trillion in 2Q16.

In the next article, we’ll delve into the economic and political challenges faced by emerging markets.