Making Sense of Boston Properties’ Geographically Concentrated Portfolio

Boston Properties concentrates on some of the highest-growth markets in the US, including Boston, New York, San Francisco, and Washington, D.C.

Dec. 4 2015, Updated 8:07 a.m. ET

Geographic coverage

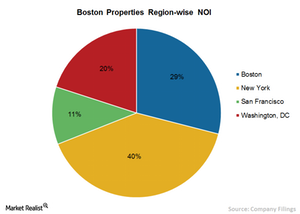

Boston Properties (BXP) is present in some of the highest-growth markets in the United States. The properties of the company are concentrated in the following four markets:

- Boston

- New York

- San Francisco

- Washington, D.C.

The company earns all its income from these four markets, and its presence in such high-growth markets has so far augured well for healthy growth.

Boston Properties’ market selection

The company’s strategy is to focus exclusively on its target markets. It aims to be one of the leading office property owners and operators in its markets, and so it targets markets and submarkets with a diverse industry base.

Otherwise put, Boston Properties seeks to enter any market with a diversified industry base and high-quality corporate tenants, with an eye toward reducing its exposure to any single industry. The company is thus likely to expand into other markets that show these same characteristics.

Market concentration risk

As mentioned above, Boston Properties has a heavy concentration in the Boston, New York, San Francisco, and Washington, D.C. markets. A slump in any of these markets due to regional issues, of course, can result in declines in demand for office space, leading to pressure on the company’s top-line.

In addition, some of the company’s markets are dependent on few industries. For example, the company’s Washington, D.C. market is thriving mainly on office properties in demand from government agencies and legal firms. A decline in government spending could result in lower demand for office space, which would adversely affect the company. Among its four markets of concentration, Washington, D.C. is the weakest market of the company, due to its lack of demand from industries like technology, financials, and life sciences, which would otherwise help compensate for the moderating demand from the government agencies, contractors, and legal firms.

By contrast, Boston Properties’ office properties market in New York is mainly driven by demand from financial, legal, and other professional firms. A significant slowdown in any of these sectors could adversely affect the demand for office properties.

Competitors and ETFs

Other major players in the office REIT (real estate investment trust) space, such as Alexandria Real Estate Equities (ARE), Kilroy Realty Corporation (KRC), and SL Green Realty Corporation (SLG), tend to follow the same portfolio diversification strategy as Boston Properties. The SPDR DJ Wilshire Global Real Estate ETF (RWO), meanwhile, invests ~1.9% of its portfolio in Boston Properties.

Continue to the next part of this series for a discussion of Boston Properties’ development and redevelopment projects.