Alexandria Real Estate Equities Inc

Latest Alexandria Real Estate Equities Inc News and Updates

Kilroy Realty Corporation: What Does it Do?

Kilroy Realty Corporation (KRC) was founded in 1996 by John B. Kilroy Jr.

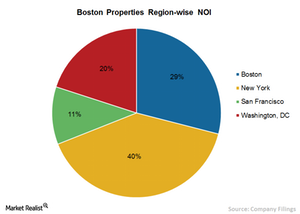

Making Sense of Boston Properties’ Geographically Concentrated Portfolio

Boston Properties concentrates on some of the highest-growth markets in the US, including Boston, New York, San Francisco, and Washington, D.C.