How Did Lululemon Athletica Compare to Its Peers?

Lululemon Athletica (LULU) has mostly outperformed its peers, namely NIKE (NKE), The GAP Inc. (GPS), and Express Inc. (EXPR), based on PE, PBV, and PS.

Dec. 10 2015, Published 8:38 a.m. ET

Lululemon Athletica and its peers

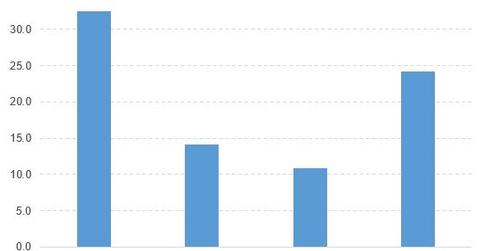

In this article, we’ll compare Lululemon Athletica (LULU) with its peers. The PE (price-to-earnings) ratios of Lululemon Athletica (LULU), NIKE (NKE), Gap (GPS), and Express (EXPR) are 24.2x, 32.5x, 10.9x, and 14.2x, respectively, as of December 9, 2015.

In addition:

- The PBV (price-to-book value) ratio of Lululemon Athletica, NIKE, Gap, and Express are 5.9x, 8.5x, 4.1x, and 2.4x, respectively.

- The PS (price-to-sales) ratios of Lululemon Athletica, NIKE, Gap, and Express are 3.4x, 3.5x, 0.67x, and 0.63x, respectively.

So, Lululemon Athletica has mostly outperformed its peers based on PE, PBV, and PS.

ETFs that invest in Lululemon Athletica

To start, the Vanguard Mid-Cap Growth ETF (VOT) invests 0.38% of its portfolio in Lululemon Athletica.

Next, the iShares Morningstar Mid-Cap Growth Index Fund (JKH) invests 0.35% of its portfolio in Lululemon Athletica. The ETF tracks a market-cap-weighted index of mid-cap companies selected by Morningstar based on their growth characteristics.

Finally, the Schwab US Mid-Cap ETF (SCHM) invests 0.28% of its portfolio in Lululemon Athletica. The ETF tracks a market-cap-weighted index of mid-cap stocks in the Dow Jones US Total Stock Market Index.

Comparing Lululemon Athletica and its ETFs

Now let’s compare Lululemon Athletica with the ETFs that invest in it:

- The year-to-date price movements of Lululemon Athletica, VOT, JKH, and SCHM are -18.8%, 0.66%, -0.76%, and 1.4%, respectively.

- The PE ratios of Lululemon Athletica, VOT, JKH, and SCHM are 24.2x, 33.5x, 35.1x, and 28.3x, respectively.

- The PBV ratios of Lululemon Athletica, VOT, JKH, and SCHM are 5.9x, 4.6x, 4.6x, and 2.5x, respectively.

According to the above findings, ETFs have outperformed Lululemon Athletica based on price movement and PE. However, Lululemon Athletica is ahead of its ETFs based on PBV.