Why Hyatt Has the Highest ADR and Occupancy Rate Among Its Peers

At 76.2%, Hyatt Hotels (H) had one of the highest occupancy rates among its peers for its owned and leased hotels in 2014.

Jan. 5 2016, Updated 10:06 a.m. ET

Hyatt Hotels dominates premium segment

Hyatt Hotels (H) operates hotels in the luxury, upper upscale, upscale, and extended stay segments. However, the portfolio is dominated by the upper upscale and luxury segments. Of the nine brands the company operates, four are from the upper upscale segment and one each from luxury and upscale segments.

The luxury and upper upscale segments offer high-end restaurants, lounges, spas, and meeting spaces along with the basic amenities. The average room price is above $200 in these segments.

How does it affect ADR?

Wyndham has one of the highest average daily rates (or ADR) among its peers due to its higher presence in the premium segments. It competitors Marriott (MAR) and Hilton (HLT) dominate the midscale and upper midscale segments, whereas Wyndham dominates the economy segment. Starwood (HOT) that also has

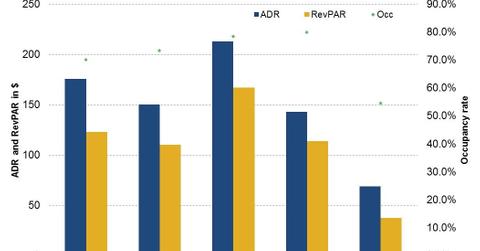

Starwood (HOT), which has a higher presence in the upper upscale and upscale segments, had an ADR of $176 in 2014. Marriott and Hilton recorded lower ADRs of $150.30 and $142.90, respectively, compared to Hyatt’s ADR of $220 in its owned and leased hotels.

Why is the occupancy rate high?

At 76.2%, Hyatt Hotels (H) had one of the highest occupancy rates among its peers for its owned and leased hotels in 2014. Of its competitors, Hilton (HLT) had the highest occupancy rate, at 79.9%, followed by Marriott (MAR) at 73.3%, Starwood (HOT) at 70.1%, and Wyndham (WYN) at 54%.

Hyatt’s larger presence in the luxury and upper-upscale segments is the reason for its higher occupancy rate. The average occupancy rate in 2014 for the luxury, upper upscale, and upscale segments were 75.1%, 72.9%, and 72.6%, respectively.

Hotels operating in these segments are normally located in urban business centers and leading tourist destinations such as Chicago, London, New York, Paris, San Francisco, Seoul, and Zurich, which have high demand. In New York alone, Hyatt had nine properties as of December 31, 2014. Further, we will discuss the effect of a high ADR and occupancy on Hyatt’s RevPAR.

RevPAR

Revenue per available room (or RevPAR), a key performance metric, is calculated by dividing hotel room revenue by room nights available to guests for a given period. Hyatt recorded the highest RevPAR among its peers at $167 in 2014. Starwood (HOT) recorded $123, followed by Hilton (HLT) at $114, Marriott (MAR) at $110, and Wyndham (WYN) at $37.60.

Investors can gain exposure to the hotel sector by investing in the First Trust US IPO Index ETF (FPX), which invests ~6% of its portfolio in the hotel sector.