Foundries to Grow Faster than Integrated Circuits in 2016

Taiwan (EWT) is the largest semiconductor manufacturer, housing the world’s top two foundries, namely TSMC (TSM) and UMC (United Microelectronics).

Dec. 24 2015, Published 1:25 p.m. ET

Expectations for the foundry business

In the earlier articles, we saw that the semiconductor industry was entering a phase of slow growth. However, the foundry business is expected to grow faster than the overall IC (integrated circuit) industry in 2016. Gartner forecasts the foundry market to grow 6% in 2016 from 5% in 2015. GlobalFoundries is more bullish and expects foundry growth between 5% and 7% in 2016.

Taiwan (EWT) is the largest semiconductor manufacturer, housing the world’s top two foundries, namely TSMC (TSM) and UMC (United Microelectronics). The two companies together hold over 60% of market share according to Gartner.

What will drive growth in 2016?

So far, the foundry growth was driven by rising demand for smartphones. But the growth of the smartphone market is slowing from 9% in 2015 to only 4.5% in 2016 according to Canaccord Genuity. However, this fall is unlikely to impact foundry growth as the RF (radio frequency) content in high-end phones rose to $12–$13 from less than $1 in older phones. Gartner analyst Samuel Wang stated that foundries with exposure in the Apple (AAPL) supply chain “will do well.”

Another product that could drive foundry growth is the 28nm[1. Nanometer] CMOS (complementary metal-oxide semiconductor) market. Research and Markets forecast the CMOS image sensor market to grow at a compounded annual growth rate of 11.8% between 2015 and 2020. Global Foundries, Samsung (SSNLF), and TSMC (TSM) offer 28nm bulk CMOS processors.

The specialty foundry business is expected to witness robust growth as demand rises for wireless ICs, power management ICs, and sensors in wearable devices, automotive, and smartphones.

Key technology developments

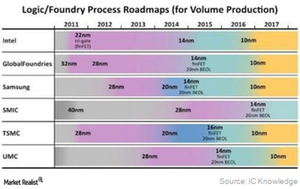

In 2015, several foundries, such as Global Foundries, Samsung, and TSMC, transitioned from 28nm and 20nm to 14nm and 16nm. With every shrinking in the size of the chip, foundries can manufacture more chips at reduced costs. However, with every reduction in nodes, the cost of transition rises as complexity increases.

Semiconductor manufacturing equipment providers Lam Research and KLA-Tencor (KLAC) expect foundries to increase 14nm and 16nm capacity and invest in 10nm technology in 2016. Samsung expects both 16nm/14nm, and 10nm technologies to coexist for a long time.

In the next part of the series, we’ll look at the challenges ahead of the foundry business in 2016.