What Is the Dodd-Frank Act?

Analysts who favor the Dodd-Frank Act believe it will protect the investing community and consumers. Critics believe it will hamper economic growth and hurt competitiveness.

Dec. 10 2015, Updated 8:05 a.m. ET

The Dodd-Frank Act

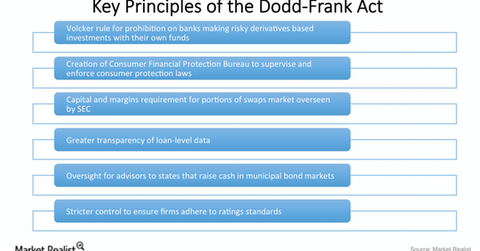

The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) is a financial reform legislation passed by the Obama administration in 2010. It was passed in an attempt to prevent events similar to the 2009 financial crisis from occurring again.

The Dodd-Frank Act primarily affects financial institutions such as banks (XLF) and their customers. It established new government agencies that monitor the performance of financial institutions that were once deemed “too big to fail.”

The established agencies under the Dodd-Frank Act have the power to liquidate or restructure companies they find to be financially weak or that may pose a risk to the financial system due to their sheer size. Another part of the act, the Volcker Rule, implemented restrictions on the way banks can invest and trade in the derivatives space. The act also requires banks to have more cash on hand and places stricter rules on lending, which makes it harder for banks to be profitable.

Analysts’ views of Dodd-Frank

Analysts who favor the Dodd-Frank Act believe it will protect the investing community as well as consumers from experiencing a situation similar to the crisis of 2008–2009. Critics of the Dodd-Frank Act believe it will hamper economic growth and hurt the competitiveness of US banks relative to their foreign peers.

Most banks, including J.P. Morgan (JPM, Wells Fargo (WFC), Citigroup (C), and Bank of America (BAC), say that implementation of the act has resulted in higher compliance costs for them. This has negatively impacted their profitability and harmed their competitiveness with their foreign counterparts. In addition, maintaining higher levels of capital hinders their ability to pay dividends to investors.