The Relative Valuation of Dry Bulk Companies

Diana Shipping is proactively investing in vessels to take advantage of the current low point for vessel valuation, and it can most likely outlast a prolonged downturn. So its valuation appears more or less full.

Nov. 20 2020, Updated 3:24 p.m. ET

Valuation multiple

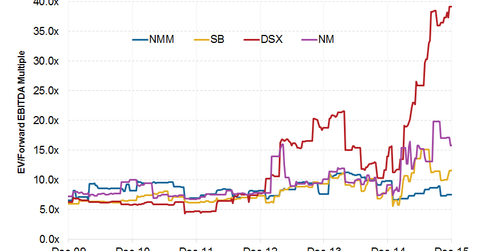

Dry bulk companies are cyclical and volatile in nature. These companies are capital-intensive with high levels of depreciation and amortization. Also, these companies have varying degrees of financial leverage. They’re better valued and compare better using EV-to-EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization).

Forward EV-to-EBITDA tells us how a company is valued for each dollar of EBITDA that the company is expected to earn. A lower ratio might indicate a company is undervalued, but not always.

While EV-to-EBITDA is a useful measure for valuing dry bulk stocks, investors should keep in mind that in an industry downturn, companies start getting valued based on their net asset values (or NAV). This is used as a floor valuation when there are no cash flows. In good times, people care about dividends.

Valuations and outlook

Due to low leverage and comfortable cash reserves in the downturn, Diana Shipping (DSX) is trading at a high EV-to-EBITDA multiple of 39x, which is the highest among its peers. The company’s one-year forward EBITDA estimates have been revised down by 70% year-to-date (until December 25, 2015). The corresponding correction hasn’t taken place in the share price. This has led to a high valuation on forward EV-to-EBITDA. The company is proactively investing in vessels to take advantage of the current low point for vessel valuations, and it can most likely outlast a prolonged downturn. So its valuation appears more or less full.

Navios Maritime Partners (NMM) is trading at a one-year forward EV-to-EBITDA of 7.5x, which is lowest in its peer universe After venturing into the container segment, its average forward EV-to-EBITDA has been 9.1x. Its historical trading range has been 5x to 11.3x. The market is probably concerned about a further dividend cut at the company.

As we discussed in our investment analysis for NMM, the company should be able to maintain its dividends at the current level with a coverage ratio of 1.2x for 2016.

Navios Maritime Holdings (NM) is also valued highly among its peers at a forward EV-to-EBITDA multiple of 15.7x, mainly due to its diversification across different businesses.

Safe Bulkers (SB) is trading at a multiple of 11.9x forward EV-to-EBITDA, which is close to the higher end of its five-year historical multiple of 13x. While there are no catalysts on the upside, it might be able to weather the current downturn through management’s prudent and conservative approach of focus on liquidity. Its younger fleet and lower breakeven costs compared to its peers are also a plus in this market.

Scorpio Bulkers (SALT), on the other hand, is a newer company with negative EBITDA estimates for the next four quarters. Scorpio Bulkers’ management has admitted in the past to misjudging the timing of the market and ordering newbuilds when the market was about to enter a very weak period. It might need to sell more vessels to remain afloat in this market.

The SPDR S&P Metals and Mining ETF (XME) gives investors exposure to the diversified metals and mining space. NM and NMM collectively form 5.1% of SEA’s holdings.

To learn more about this industry, visit our Dry Bulk Shipping page.