Automotive Segment to Drive Growth in the Semiconductor Market

Automotive semiconductor revenue has grown at a CAGR (compounded annual growth rate) of 8% between 2002 and 2012, according to McKinsey.

Dec. 28 2015, Published 5:33 p.m. ET

2016 automotive semiconductor forecast

In the previous part of this series, it was mentioned that the automotive and industrial sectors would drive growth in the semiconductor industry. Automotive semiconductor revenue has grown at a CAGR (compounded annual growth rate) of 8% between 2002 and 2012, according to McKinsey.

However, this growth has slowed, from 7.3% in 2014 to 5.7% in 2015, and it is expected to be 3.7% in 2016, according to Reportlinker. The slowdown is attributed to the strengthening of the US dollar and an expected 2% fall in China’s automotive market.

However, IC Insights expects the automotive segment to grow at a CAGR of 6.7% between 2014 and 2019, the fastest among all semiconductor end user applications.

Key developments

The automotive semiconductor market has witnessed consolidation in 2015. NXP Semiconductors (NXPI) acquired Freescale, and ON Semiconductors (ON) acquired Fairchild Semiconductors (FCS) in 2015. Qualcomm (QCOM) and Nvidia (NVDA) also entered this space to boost revenues.

Automotive semiconductor products

There are five types of automotive semiconductors:

- Power semiconductor – Infineon leads this market, followed by STMicroelectronics (STM) in second place.

- Sensor semiconductor – Sensata leads this market, followed by Bosch in second place.

- Processor semiconductor – Renesas leads this market, followed by Freescale in second place.

- ASSP (application specific standard product) semiconductor

- Logic semiconductor

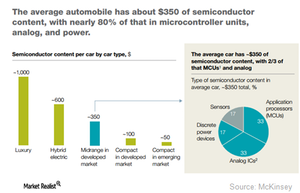

The semiconductor content in vehicles is increasing, with mid-range cars containing $350 worth of semiconductor content. The automotive semiconductor’s product life cycle is lengthy and complex, thus making automakers reluctant to switch semiconductor suppliers, as it entails high switching costs. Moreover, the supply agreements are for longer terms, thus reducing the risk of losing customers to competitors.

Key growth drivers for automotive semiconductors

Vehicle growth – An increase in the demand for vehicles will increase the demand for automotive semiconductors. China’s (FXI) automotive sales are expected to grow at 11.2% CAGR during 2014–2019, according to PricewaterhouseCoopers (or PwC).

Semiconductor content growth – An increase in the semiconductor content in vehicles will drive growth. HEVs (hybrid and electric vehicles) pose a unique growth opportunity, as emission control policies are encouraging adoption of such vehicles. PwC expects semiconductor content sales for HEV to grow at a CAGR of 20.5% during 2014–2019.

Application growth – New semiconductor technology that offers more applications can drive demand for automotive semiconductors. According to IHS, electronics in HEV, telematics and connectivity, and ADAS (advanced driver assistance systems) are the fastest-growing segments.