Analyzing Medtronic’s Restorative Therapies Group Segment

Medtronic’s Restorative Therapies Group’s net sales in fiscal 2015 reached ~$6.8 billion, which represents an increase of 4% over the prior fiscal year.

Dec. 2 2015, Updated 10:07 a.m. ET

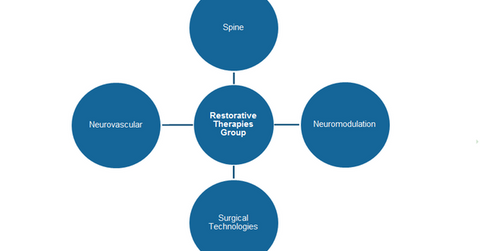

Restorative Therapies Group: overview

Medtronic’s Restorative Therapies Group’s net sales in fiscal 2015 reached ~$6.8 billion, which represents an increase of 4% over the prior fiscal year. The group’s performance was favorably impacted by the addition of its Neurovascular division, formerly part of Covidien. Major competitors of Medtronic (MDT) in this space include Johnson & Johnson (JNJ), Boston Scientific Corporation (BSX), Stryker Corporation (SYK), and Zimmer Biomet Holdings.

The Spine division

Medtronic’s Spine division develops and manufactures medical devices and implants used in the treatment of the spine and musculoskeletal system, which refers to the combination of the muscular and skeletal systems, which provides support and stability to the body and includes bones, muscles, tendons, and ligaments.

In 2015, Medtronic’s net sales from the Spine division witnessed a decline of 2% over the prior fiscal year. The long-term growth and differentiation strategy for the core Spine business continued to focus on procedural innovation, portfolio updates, and the Surgical Synergy program, which integrates imaging, navigation, and powered surgical instruments.

In fiscal 2015, the Spine division saw several new product launches, including the following:

- Prestige LP cervical disc and Pure Titanium Coated (PTC) interbody spacers, which help restore normal disc height to treat patients experiencing pain caused by compression of the spinal cord or nerve roots

- Interventional Spine therapies, which are minimally invasive therapies for the treatment of spine pain and discomfort

- BMP (Bone Morphogenetic Protein), a genetically engineered version of a naturally occurring protein that initiates bone growth in targeted areas of the spine, providing alternatives to the painful harvesting of bone graft from other parts of the body and the use of bone harvested from cadavers

The Neuromodulation division

Medtronic’s Neuromodulation division includes implantable neurostimulation and targeted drug delivery systems for the management of chronic pain, common movement disorders, and gastrointestinal disorders. Neurostimulation uses an implantable medical device, similar to a pacemaker, called a neurostimulator. Some of the major products in the Neuromodulation division include the following:

- the SureScan MRI system, a full body MRI (Magnetic Resonance Imaging) scan system

- DBS (Deep Brain Stimulation) Systems, which are used for the treatment of the disabling symptoms of essential tremor, Parkinson’s disease, refractory epilepsy

- the SynchroMed II Implantable Infusion System, which is used to treat chronic, intractable pain and severe spasticity associated with cerebral palsy, multiple sclerosis, spinal cord, and traumatic brain injuries, as well as strokes

The Surgical Technologies division

Medtronic’s Surgical technologies division develops and manufactures products and therapies to treat ENT (ear, nose, and throat) diseases as well as certain neurological disorders. In addition, this division develops, manufactures, and markets image-guided surgery and intra-operative imaging systems that facilitate surgical planning.

The Surgical Technologies division’s net sales in fiscal 2015 were ~$1.7 billion, which represents an increase of 7% over the prior fiscal year. Some of this division’s major products include:

- PEAK PlasmaBlade technologies, a tissue dissection system used in plastic reconstructive surgery, general surgery, and certain conditions of ENT

- Midas Rex products, which are used for a wide range of surgeries including spine and ENT

- NuVent sinus balloons, which are used for sinus surgery

For diversified exposure to Medtronic, investors can invest in the iShares Global Healthcare ETF (IXJ), which has ~2.5% of its total holdings in the company.

Continue to the next part of this series for a critical look at Medtronic’s geographic strategy in 2015.