Analyzing Conagra Brands’ Growth Drivers

Conagra Brands (CAG) shares have risen 21.1% since the company reported its third-quarter earnings on March 21.

March 29 2019, Published 1:08 p.m. ET

Growth drivers

Conagra Brands (CAG) shares have risen 21.1% since the company reported its third-quarter earnings on March 21. Conagra Brands’ bottom line fell on a YoY (year-over-year) basis in the third quarter. Higher interest expenses and the increased outstanding share count took a toll on the company. However, the earnings beat analysts’ expectation due to the expanded operating margin.

The company reduced its debt by $685 million within five months after it closed the Pinnacle Foods acquisition. Reducing the debt lowers the pressure on Conagra Brands’ earnings by lowering the interest burden. Management’s positive outlook on Pinnacle’s integration and execution also lifted investors’ sentiment on the stock.

Outlook

We expect Conagra Brands’ net sales to continue to grow at a strong double-digit rate in the coming quarters due to the Pinnacle Foods acquisition and sustained momentum in its base business. Higher organic volumes and improved pricing and mix are expected to support Conagra Brands’ organic sales.

Strong productivity savings are expected to support the operating margin expansion.

We expect Conagra Brands’ adjusted EPS to continue to decline in the coming quarters, which reflects increased input costs, higher interest expenses, and the increased outstanding share count. However, the earnings are expected to stabilize in the second half of fiscal 2020 and record strong growth.

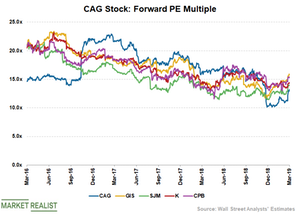

Conagra Brands stock is trading at a forward PE ratio of 13.2x, which is ~23% lower than its three-year average multiple of 17.1x. Conagra Brands stock has risen 29.9% on a YTD (year-to-date) basis as of March 28. The stock has outperformed the benchmark index. Conagra Brands stock has a current dividend yield of more than 3%.

Conagra Brands stock is trading at a lower valuation multiple than most of its peers. General Mills (GIS), Campbell Soup (CPB), Kellogg (K), and J.M. Smucker (SJM) stock are trading at forward PE ratios of 15.8x, 15.4x, 14.3x, and 14.0x, respectively.