What’s Driving Asia’s Growth?

For the last three decades, Asia has posted higher economic growth than any other region of the world.

May 31 2017, Updated 12:05 p.m. ET

Matthews Asia

This dramatic economic “lift-off” has been driven by three key factors: high savings rates, total factor productivity and structural economic changes. While each is significant, it is the combination of these factors, together with other supporting elements, that account for the region’s more rapid relative growth compared to other emerging markets.

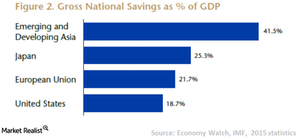

Savings Rates: Asia’s ability to save and invest efficiently in its economy—and its high savings rate as compared with other developed and emerging economies—drives much of its appeal as an investment destination. The region’s savings rate has far-reaching implications for its economic growth, social stability and productivity. Domestic savings are an inherently more stable investment source than are foreign-sourced investment flows that vary with economic cycles. Domestic savings are a particularly valuable source of investment for long-term projects in infrastructure and education.

Asia has been uniquely successful in this regard, generating robust savings for investment and providing the region with investment capital for future growth. Led by China’s 46% savings rate, the Emerging and Developing Asian countries rank among the highest in the world on this measure.

Market Realist

Asia’s savings glut

For the last three decades, Asia has posted higher economic growth than any other region of the world, which partly explains its higher savings rate. The higher rate boosts income and government tax receipts.

As Asian economies grew rapidly, the propensity to save increased. The combined savings rate of Asia’s prominent economies—China (FXI) (GXC), Japan, South Korea (EWY), Taiwan (EWT), Hong Kong, and Singapore—rose to 40% of its GDP in 2015 from 35% in 2005. In terms of absolute numbers, the savings of these nations’ economies have grown from $2.8 trillion in 2005 to around $7 trillion. China’s savings have risen from $1 trillion to more than $5 trillion.

Shift in business model

As shown in the chart above, savings rates in Asia (AAXJ), excluding Japan, are higher than European rates and much higher than US rates. The United States has been reporting persistently lower savings rates. The biggest advantage of higher savings rates in Asia (EEMA) is the business shift from a debt-driven model to an equity-driven model.