Understanding Deutsche Bank’s Segments

Deutsche Bank operates under five segments. Corporate Banking & Securities contributes 50% to Deutsche Bank’s revenues.

Nov. 6 2015, Updated 4:07 p.m. ET

Deutsche Bank’s operating segments

In this part of the series, we’ll analyze the performance of Deutsche Bank’s segments. Deutsche Bank (DB) reported losses of 6 billion euros for the third quarter. Third-quarter results were impacted by a 5.8-billion-euro impairment in goodwill and other intangible assets recorded in the Corporate Banking & Securities division and the Private Business Client division.

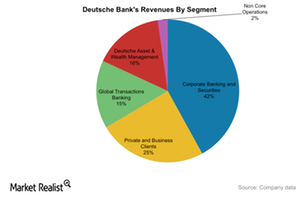

Deutsche Bank operates under the following segments:

- Corporate Banking & Securities (or CB&S) – This segment consists of two business divisions, Corporate Finance and Markets, and offers a range of financial products. It contributes ~50% to Deutsche Bank’s revenues.

- Private & Business Clients (or PBC) – This segment consists of three business units: Private and Commercial Banking, Advisory Banking International, and Postbank. In April 2015, Deutsche Bank announced plans to split off its Postbank business as part of its overhaul strategy.

- Global Transaction Banking (or GTB) – This segment delivers commercial banking products and services to corporate clients and financial institutions.

- Deutsche Asset & Wealth Management (Deutsche AWM) – This segment is an investment organization that offers investments across various asset classes to individuals and institutions.

- Non-Core Operations Unit (or NCOU) – This segment operates as a separate division alongside Deutsche Bank’s core businesses.