What’s the Volatility of Mining Stocks?

Though the precious metals survived the Fed’s interest rate hike, the miners took a hit. Most mining stocks saw a considerable down day on Wednesday.

June 16 2017, Updated 12:05 p.m. ET

Mining stocks

Though precious metal prices survived the Fed’s interest rate hike, miners’ stock prices took a hit. Most mining stocks saw a considerable down day on Wednesday.

In this article, we’ll talk about the crucial technicals like implied volatility and RSI levels of a few miners including Randgold Resources, Pan American Silver, Barrick Gold, and Cia De Minas Buenaventura. These four stocks fell 1.5%, 4%, 2.3%, and 3%, respectively, on June 14.

Implied volatility

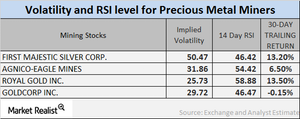

Implied volatility is a measure of the fluctuation in the price of an asset with respect to the changes in the price of its call option. On June 14, 2017, Randgold Resources (GOLD), Pan American Silver (PAAS), Barrick Gold (ABX), and Cia De Minas Buenaventura’s (BVN) implied volatility stood at 26.6%, 37.3%, 30.8%, and 38.2%, respectively. The volatility of mining stocks is often higher than the volatility of precious metals.

RSI scores

The 14-day RSI score determines whether an asset is oversold or overbought. An RSI score above 70 suggests a price slump, while anything below 30 suggests a price gain.

Often, the higher the score, the higher the RSI. Randgold, Pan Amerian, Barrick, and Cia De Minas have RSI scores of 49.1, 36.9, 37.8, and 38.1, respectively.

The gold-based and silver-based funds like the Physical Swiss Gold Shares (SGOL) and the Physical Silver Shares (SIVR) are also drastically impacted by the changes in metal. These two funds have managed to rise 9.4% and 5.6%, respectively, year-to-date.