How Equinix Rewards Its Shareholders

Equinix (EQIX) announced a dividend of $2.00 per share for 3Q17, leading to a total of $8.00 for 2017 and up from $7.00 in 2016.

Jan. 22 2018, Updated 10:31 a.m. ET

EQIX’s dividend policy

Equinix (EQIX) announced a dividend of $2.00 per share for 3Q17, leading to a total of $8.00 for 2017 and up from $7.00 in 2016. The company’s dividend yield stands at ~1.8%, and it paid a dividend of $6.76 in 2015. Equinix’s three-year dividend CAGR[1. compound annual growth rate] is 9.0%.

Payout ratio

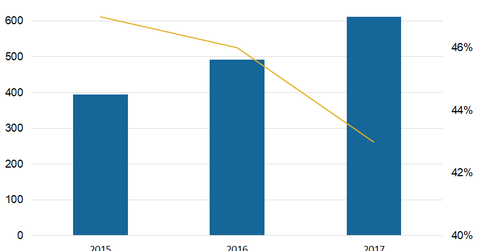

Equinix’s estimated total dividends for 2017 is expected to be $612.0 million for a payout ratio of 43.0%. In 2016, the company’s payout ratio was 46.0% with total dividends of $492 million.

In 2015, EQIX paid $394 million in dividends with a payout ratio of 47.0%. The company’s total payout equals an increase of 24.0% year-over-year.

Dividend yields among Equinix’s peers

Equinix’s (EQIX) dividend yield is ~1.8%. Among its peers, the dividend yield for Digital Realty Trust (DLR) stands at ~3.5%, the dividend yield for CoreSite Realty (COR) is ~3.7%, and Cyrus One (CONE) has a dividend yield of ~3.0%.

EQIX has the lowest dividend yield among its peers, and it forms ~4.2% of the iShares Core US REIT ETF (USRT).

Stock price performance

Equinix’s (EQIX) stock price has gained ~16.5% in the last one-year period while NASDAQ (IXIC) fallen ~10.6%. This gain was mostly due to positive fundamentals and strong growth.

Among Equinix’s peers, Digital Realty Trust’s (DLR) one-month return is ~-7.9%, its three-month return is ~-13.8%, and its one-year return is -3.2%.

CoreSite Realty (COR) returned ~-8.6% in one month, ~-7.1% in three months, and ~27.3% in the last one-year period. Cyrus One (CONE) returned ~-6.2% in one month, ~-12.0% in three months, and ~12.7% in the last one-year period.