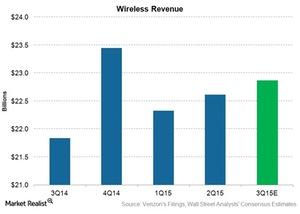

Verizon’s Wireless Revenue in 3Q15

Verizon’s wireline segment revenue decreased ~2.2% year-over-year to ~$9.4 billion during the quarter.

Oct. 19 2015, Updated 9:08 a.m. ET

Verizon’s wireless revenue in 3Q15

In the previous part of this series, we noted that Verizon’s (VZ) wireless segment supported the consolidated revenue growth in 2Q15. Verizon’s wireline segment revenue decreased ~2.2% year-over-year (or YoY) to ~$9.4 billion during the quarter. However, Verizon’s wireless segment revenue increased by ~5.3% YoY to reach ~$22.6 billion during 2Q15.

Wall Street expects the growth trend in the telecom company’s wireless segment to continue in 3Q15. Based on the consensus estimates of Wall Street analysts, Verizon’s wireless revenue is expected to grow by ~4.7% to reach ~$22.9 billion in 3Q15.

Verizon’s wireless revenue in 2Q15

The two largest components of Verizon’s wireless revenue are service and equipment revenues. The service revenue is the most significant component, representing ~78.2% of the segment’s total revenue during 2Q15. These service revenues are relatively stable revenue streams of wireless telecom companies such as Verizon, Sprint (S), AT&T (T), and T-Mobile (TMUS).

Verizon’s wireless service revenue decreased by ~2.2% YoY to reach ~$17.7 billion during 2Q15. This was due to the declining unit contribution of postpaid subscribers during the quarter.

Meanwhile, Verizon’s wireless equipment revenue supported the segment’s revenue growth. This revenue stream increased by ~61.8% YoY to reach ~$3.9 billion in 2Q15. The growth in equipment revenue was positively affected by the higher adoption of Verizon’s Edge installment plan during the quarter.

Instead of taking a direct exposure to Verizon’s stock, you may take broad-based exposure to the company by investing in the SPDR Dow Jones Industrial Average ETF (DIA). DIA held ~1.9% in Verizon at the end of August 2015.