Understanding Ross Stores’ Business Model

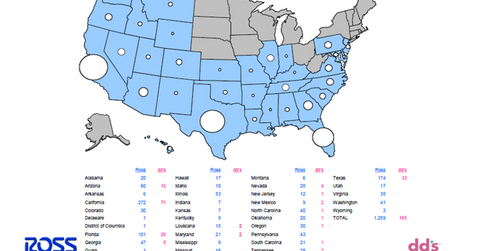

Ross Stores operates under two trademarks: Ross Dress for Less and dd’s DISCOUNTS. There are 1,259 Dress for Less and 165 dd’s DISCOUNTS stores in the US.

Oct. 23 2015, Published 3:26 p.m. ET

Store categories

Ross Stores (ROST) operates under two trademarks: Ross Dress for Less and dd’s DISCOUNTS. The Ross Dress for Less stores offer a wide range of selection at 20–60% below department and specialty store regular prices. The dd’s DISCOUNTS stores offer products at 20%–70% below moderate department and discount store regular prices.

As of August 1, 2015, Ross Stores operated 1,259 Ross Dress for Less store locations in 33 states, the District of Columbia, and Guam, and 165 dd’s DISCOUNTS stores in 15 states. TJX Companies (TJX) had 2,629 stores in the United States as of August 1, 2015, and 832 stores in Canada and Europe. Burlington Stores (BURL) operated 546 retail stores in the United States as of August 1, 2015.

Off-price concept

Off-price stores such as TJX Companies and Ross Stores have been able to perform better than department stores, even during difficult economic times, due to the bargain deals that they offer consumers.

So how do off-price retailers like Ross Stores make profits? Ross Stores acquires the majority of its merchandise through opportunistic purchases arising from manufacturer overruns and canceled orders both during and at the end of a fashion season.

The company refers to these purchases as “close-out” and “packaway” purchases. Generally, close-out purchases can be shipped to stores in-season, allowing Ross Stores to obtain in-season merchandise at lower prices.

Packaway merchandise, which are mainly fashion basics and are generally not affected by fashion trends, are purchased with the intention to be stored in the company’s warehouses until a later date. This later date can even be the beginning of the same selling season in the following year.

The purchase of packaway merchandise helps Ross Stores to increase the proportion of popular national brands in its merchandise at competitive savings.

Ross Stores, like its other off-price counterparts, keeps its stores simple and has no window displays, mannequins, fancy fixtures, or decorations. This ensures that the company can pass more savings on to its customers.

ETF exposure

Ross Stores is a part of several ETFs including the Consumer Discretionary Select Sector SPDR ETF (XLY), the First Trust Consumer Discretionary AlphaDEX ETF (FXD), and the iShares S&P 500 Growth ETF (IVW). Ross Stores constitutes 0.9%, 0.8%, and 0.2% of these ETFs, respectively.

In the next part of this series, we’ll look at the sales mix of Ross Stores.