With SanDisk Purchase, Western Digital Will Pass Samsung in SSD

With the action on the acquisition front, including the SanDisk acquisition, Western Digital is geared up to increase and enhance its presence in the SSD arena.

Oct. 26 2015, Updated 9:06 a.m. ET

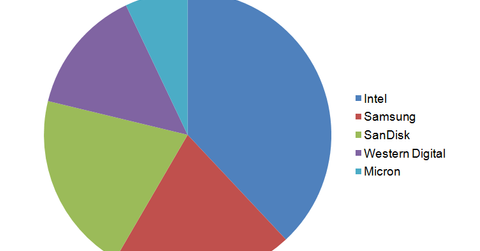

Intel leads enterprise SSD space

Previously in this series, we saw various aspects of the recently announced acquisition of SanDisk (SNDK) by Western Digital (WDC). Let’s see how the SanDisk acquisition will provide Western Digital with a new avenue of growth as well as boost its market share in the enterprise SSD (solid-state drive) space.

Intel (INTC) leads the enterprise SSD space with a 27.4% share. It’s followed by Samsung (SSNLF) and SanDisk. Both of them claimed a 14.7% market share in 2014. Western Digital and Micron (MU) held 10.2% and 5.1% of the market share, respectively.

SanDisk acquisition will put Western Digital way ahead of all but one of its peers in the SSD space

For the fiscal year ended July 3, 2015, less than 6% of Western Digital’s overall revenues were generated from enterprise SSDs. As we’ve already seen, if Western Digital integrates SanDisk into its portfolio, Western Digital’s market share will increase more than two times, or approximately 25% over the current share. Western Digital would be ahead of Samsung and only behind Intel in the SSD space.

Western Digital’s strategic acquisitions have strengthened its portfolio

In December 2014, Western Digital acquired Skyera, a flash storage array manufacturer, in an all-cash transaction. In 2013, Western Digital made the following acquisitions in the SSD space:

- sTec, an SSD manufacturer

- Virident Systems, an enterprise flash storage company

- Velobit, a storage optimization software company

So with all the action on the acquisition front, Western Digital is all geared up to increase and enhance its presence in the SSD arena.

You can consider investing in the SPDR S&P 500 ETF (SPY) to gain exposure to the tech sector. SPY invests about 18% of its holdings in the technology sector.