How Does NRG Energy Earn Its Revenues?

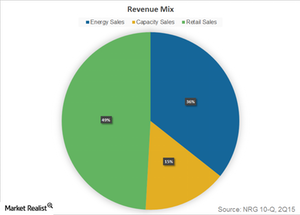

NRG Energy (NRG) earns revenues in three primary ways across its segments: energy sales, capacity sales, and retail sales.

Oct. 15 2015, Published 1:13 p.m. ET

NRG’s revenue streams

NRG Energy (NRG) earns revenues in three primary ways across its segments:

- Energy sales

- Capacity sales

- Retail sales

NRG Energy’s sales

NRG Energy’s (NRG) energy sales include revenues generated in the wholesale market, as well as revenues generated by the company’s renewable energy segment through power purchase agreements with third parties. The company operates in major electricity markets in the US, including:

- PJM: covering 13 states

- NYISO: covering New York

- ISO-NE: covering six states

- ERCOT: covering Texas

- CAISO: covering California

Energy sales accounted for 36% of the company’s total revenues during 2Q15. Energy sales also include revenues generated by NRG Yield (NYLD).

NRG’s capacity sales

NRG Energy’s capacity sales refer to revenues generated through selling generation capacity for future usage. In short, the company makes its capacity available to third parties for future usage through auctions.

Numerous factors including the current demand-supply situation in the market, natural gas prices, demand forecasts, upcoming capacities, and retirements come into play while determining capacity prices, leading to volatility in capacity prices across and within markets. Capacity sales accounted for 15.4% of the company’s overall revenues in 2Q15.

NRG’s retail sales

NRG Energy made a full-fledged entry into the retail business through the acquisition of Reliant Energy in 2009. Just like other regulated utilities (XLU), the company’s retail operations earn revenues by selling electricity to residential, commercial, and industrial customers in Texas and in the Northeast. Retail sales accounted for 49.6% of the company’s revenues in 2Q15.

With this background, let’s have a look at the company’s financial performance during 2Q15 in the next part.