NRG Yield Inc

Latest NRG Yield Inc News and Updates

Yieldco: A Green Investment Option That Pays

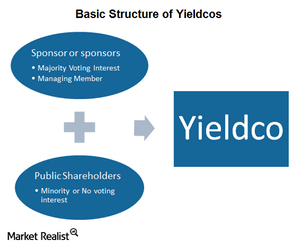

While REITs started trading in 1951 and MLPs started off in 1981, the first yieldco was floated in 2005 by Seaspan Corporation, a shipping company.

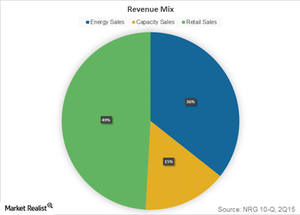

How Does NRG Energy Earn Its Revenues?

NRG Energy (NRG) earns revenues in three primary ways across its segments: energy sales, capacity sales, and retail sales.