Novo Nordisk Plans to Pursue Leadership in Hemophilia Market

Novo Nordisk is pursuing leadership in the hemophilia market with its new drugs as well as a few investigational hemophilia drugs in its late-stage research pipeline.

Oct. 6 2015, Updated 11:07 a.m. ET

Hemophilia and Novo Nordisk

On February 23, 1996, the European Commission granted market authorization for NovoSeven, valid throughout the European Union, and Novo Nordisk (NVO) thus entered the hemophilia market.

According to the Indiana Hemophilia & Thrombosis Center, “Hemophilia is a rare bleeding disorder that results from reduced levels or lack of clotting factor VIII (FVIII; hemophilia A) or IX (FIX; hemophilia B). Normal blood clotting is a complex process that involves as many as 20 blood proteins called clotting factors. The shortage or absence of one of these factors, as happens in hemophilia, may disrupt the clotting process.”

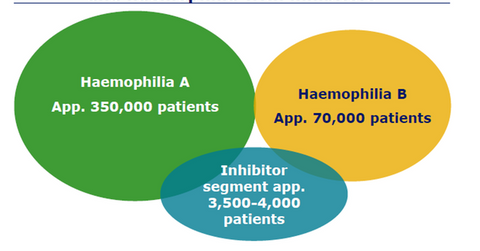

About 420,000 patients in the world are afflicted with hemophilia, with 350,000 patients suffering from hemophilia A and 70,000 patients suffering from hemophilia B. NovoSeven is a drug targeted at the 3,500–4,000 patients belonging to the inhibitor segment.

Haemophilia Care explains the characteristics of patients in the inhibitor segment. “People with haemophilia usually receive treatment (known as ‘factor replacement therapy’) to help their blood to clot. However, in some people, the immune system will start to believe the treatment is harmful. The immune system will then start to produce antibodies to block the effects of the treatment. These antibodies are known as ‘inhibitors.’”

On October 15, 2013, the FDA (U.S. Food and Drug Administration) approved the biologics license application (or BLA) for Novo Nordisk’s NovoEight. This approval enabled the company to move from the inhibitor niche to the larger hemophilia A market.

On December 23, 2013, the FDA approved Tretten for patients suffering from congenital factor XIII (or FXIII) A-subunit deficiency. Novo Nordisk is pursuing leadership in the hemophilia market with its new drugs as well as a few investigational hemophilia drugs in its late-stage research pipeline.

Hemophilia market opportunity

The global hemophilia market is worth 56 billion DKK (Danish krone currency) and is growing at an annualized rate of 5%. Only 45% of all hemophilia patients are diagnosed, while only 15% of the total patients actually receive any treatment.

Prophylactic treatment involves regular therapy to reduce the severity of hemophilia. Only 6% of the total hemophilia patients currently receive prophylactic treatment, while 3% of the total hemophilia patients receive treatment for hemophilia-associated joint pain.

These numbers underline the scale of opportunity currently unexplored in the hemophilia market. Companies such as Novo Nordisk, Baxter International (BAX), Biogen (BIIB), and Pfizer (PFE) have been actively exploring the hemophilia market.

Investors can get exposure to Novo Nordisk’s hemophilia portfolio and avoid excessive company-specific risks by investing in the VanEck Vectors Pharmaceutical ETF (PPH). Novo Nordisk accounts for 5.05% of PPH’s total holdings.

Investors can get exposure to Novo Nordisk’s hemophilia portfolio and avoid excessive company-specific risks by investing in the VanEck Vectors Pharmaceutical ETF (PPH). Novo Nordisk accounts for 5.05% of PPH’s total holdings.