Why Nike Is Upbeat on Its Geographic Segments

Western Europe is Nike’s (NKE) second-largest segment. The segment’s revenues grew at a mid- to high-teens rate to $5.7 billion in fiscal 2015.

Oct. 26 2015, Updated 6:05 p.m. ET

Analyzing Nike’s sales projections for Western Europe

Western Europe is Nike’s (NKE) second-largest segment. According to Nike’s CFO (Chief Financial Officer), Andy Campion, “we’re the leading brand in all ten of the key cities in Western Europe and our financial performance reflects that.”

The segment’s revenues have grown at a mid- to high-teens rate in the last two years, to come in at $5.7 billion in fiscal 2015. At its 2015 Investor Day held on October 14, Nike mentioned that it expects the segment to grow at a high single-digit pace over the next five years. The segment’s key growth drivers include gains in women’s, young athletes’, football, sportswear, basketball, and men’s training. Nike is looking at a bigger footprint of owned stores, higher sales from Nike.com, as well as sales via partnerships with sporting goods retailers (XRT).

Emerging Markets

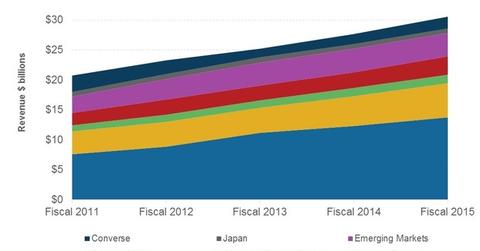

Nike’s revenue from emerging markets has about doubled over the past five years, reaching $4 billion in fiscal 2015. Nike expects the segment to grow at a low double-digit pace annually over the next five years, despite macro and currency headwinds in certain markets.

Gains are expected to be spurred by football, sportswear, and running. Nike is also expecting the women’s and young athletes businesses to deliver strong growth as per comments by Andy Campion, CFO of Nike.

Peers plan international growth

Nike’s competitors are also looking closely at the opportunities in Western Europe and Asia. Lululemon Athletica (LULU) is engaged in opening its stores and has reported upside in Asia and Western Europe.

Also, Under Armour (UA) is looking at rolling out new international stores, though most of them would come via partnerships with distributors and sporting goods retailers.

Nike makes up 2.9% and 3.8% of the portfolio holdings in the Vanguard Consumer Discretionary ETF (VCR) and the Consumer Discretionary Select Sector SPDR Fund (XLY), respectively.