How Did Cybersecurity ETF HACK Perform Last Week?

HACK closed at $27.10 with a positive return of 1.3% on Friday, November 6, 2015, generating a profit of 1.1% for the week.

Nov. 9 2015, Published 5:32 p.m. ET

Overview

In this article, we’ll examine the performance of cybersecurity stocks within the broad technology sector, and track the weekly performance of the PureFunds ISE Cyber Security ETF (HACK) and its components. HACK closed at $27.10 with a positive return of 1.3% on Friday, November 6, 2015, generating a profit of 1.1% for the week.

From November 2 to November 6, 2015, the technology sector generated a reasonable return. The Technology Select Sector SPDR ETF (XLK), the Vanguard Information Technology ETF (VGT), the First Trust Dow Jones Internet ETF (FDN), and the iShares North American Tech-Software ETF (IGV) generated 1.6%, 2.1%, 3.1%, and 2.7%, respectively, for the trailing five days.

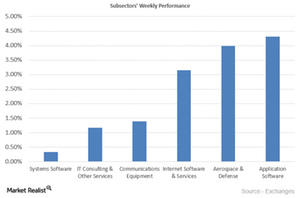

Subsector performance

Application Software was the best performing sector, generating a return of 4.3%. Within the sector, Splunk (SPLK) and Gemalto generated returns of 7.1% and 6.1%, respectively, for the trailing five days. The next best performing sector was Aerospace and Defense, generating a return of 4.0%. The Aerospace and Defense sector consists of KEYW Corporation (KEYW) and Exelis (XLS), which showed returns of 8.8% and -0.85%, respectively.

System Software, which constitutes around 60% of HACK’s total holdings, generated a marginal profit of 0.33% for the trailing five days. AVG Technologies (AVG) had the strongest impact on this sector, showing a negative return of 17.4%, followed by FireEye (FEYE) with 8.9%. Market reactions remained negative on the company’s earnings announcements last week, driving both stocks down. Within the sector, Barracuda Networks (CUDA), F-Secure Corporation, and VASCO Data Security International (VDSI) were the best performing stocks, generating returns of 10.4%, 8.8%, and 6.7%, respectively, on November 6, 2015.