Exelis Inc

Latest Exelis Inc News and Updates

Industrials Consider these key risks facing Lockheed Martin

The U.S. government is Lockheed Martin’s (LMT) major customer. With almost 82% of its revenues from the U.S. government, LMT highly depends on the government.Industrials An overview of Lockheed Martin’s business segments

Lockheed Martin (LMT) operates in five business segments—Aeronautics, Information Systems & Global Solutions, Mission and Fire Controls, Mission Systems & Trainings, and Space Systems.

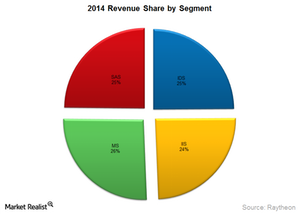

What Should Investors Know About Raytheon?

Raytheon is a leading technology company. It provides products and services in the defense, civil, and security markets globally.