Credit Risk and Interest Rate Risk Have a Negative Correlation

Credit markets tend to improve when the economy is improving. The possibility of a default on corporate bonds (LQD) drops, thus causing their yields to fall.

Nov. 5 2015, Updated 7:05 p.m. ET

Here are two things you need to understand about credit risk and interest rate risk.

1. An investor is generally paid for taking on these risks. If you buy a short term Treasury bond you are taking on only a small amount of interest rate risk, and in return you will receive a small amount of yield potential. Buy a longer maturity Treasury and you are exposed to more interest rate risk but are generally paid for it in the form of higher yield potential. Similarly, a high quality corporate bond should provide yield to compensate an investor for credit risk, and a low quality corporate bond typically pays a higher yield as it carries more credit risk.

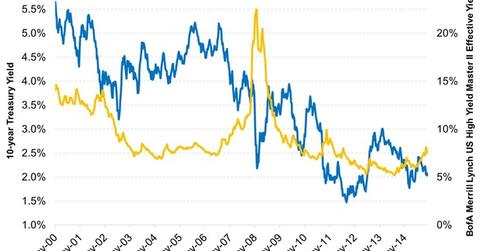

2. Historically, credit risk and interest rate risk have had a negative correlation. (Source: Barclay’s Index data, 1988-12/31/2014.) This means that often when one of them is rising, the other is falling. Thus having both credit risk and interest rate risk in your portfolio can provide diversification. The two risks help balance each other out.

Market Realist – Credit risk and interest rate risk have a negative correlation.

The graph above compares the yield on high yield bonds (HYG)(JNK) with that on the ten-year Treasury (IEF). As you can see, the yields on the two tend to move in opposite directions. The difference between the yield of the two is referred to as “credit spread.”

Usually, when the economy is on an upswing, credit spreads contract. This is because credit markets tend to improve when the economy is improving. The possibility of a default on corporate bonds (LQD) drops, thus causing their yields to fall. Meanwhile, as the economy improves, Treasury (TLT) yields rise as investors move to riskier assets. This causes the credit spread to contract.

The opposite happens when the economy is in a downturn. Investors turn to Treasuries and other safe assets, dumping risky assets like high yield bonds, which now have heightened default risks, causing their yields to rise and credit spreads to expand.

In the next part, we will discuss an ETF that gives you exposure to both risks.