Why Coty’s Capital Expenditure Could Rise

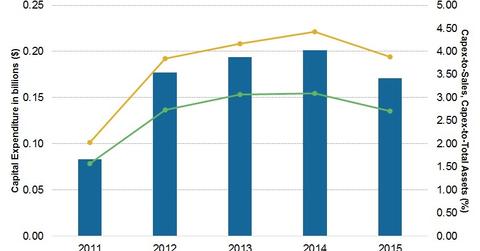

Coty Inc.’s capital expenditure decreased 15.2% to $0.17 billion in fiscal 2015, compared to $0.20 billion in fiscal 2014.

Nov. 20 2020, Updated 3:38 p.m. ET

Analyzing Coty’s investment focus

Coty’s (COTY) net cash used in investing activities for fiscal 2015[1. Year ended June 30, 2015] came in at approximately -$0.2 billion, compared to -$0.3 billion in fiscal 2014. The decrease in investment expenditure was primarily due to lower capital expenditure.

Coty Inc.’s capital expenditure decreased 15.2% to $0.17 billion in fiscal 2015, compared to $0.20 billion in fiscal 2014. The decrease was due to lower capital spent to build additional capacity. As a result, the company’s capital expenditure as a percentage of sales decreased to 3.9% in fiscal 2015, compared to 4.4% in fiscal 2014.

Peers capex-to-sales

Peers Estée Lauder (EL) and L’Oréal (LRLCY) have higher capex to sales ratios at 4.4% in fiscal 2015 and 4.5% in fiscal 2014, respectively compared to COTY. The increase in EL’s capex-to-sales ratio was primarily due to higher spending on leasehold improvements and counters.

However, the capital expenditure as a percentage of sales for Beiersdorf (BDRFF) came in at 4.8% in fiscal 2014, and Procter & Gamble’s (PG) capex was 4.9% in fiscal 2015[2. Year end for Estée Lauder and Procter & Gamble is June 30, 2015; for L’Oréal and Beiersdorf, it is December 31, 2014].

Capacity additions

After Coty’s merger with Procter & Gamble’s 43 beauty brands is complete, the company would need to spend $400 million in capex to build additional capacity in order to realize cost savings. To learn more about this deal, please read Benefits of Coty’s Merger with Procter & Gamble’s Beauty Brands.

The company’s focus is to spend more capital on research and development (or R&D) for the development of new products, as well as the investment in more media formats, both of which can positively impact product sales.

Coty has exposure in the First Trust Consumer Discretionary AlphaDEX ETF (FXD), with 0.9%[3. Updated as of October 7, 2015] of the total weight of the portfolio.