Analyzing China’s Leverage and Deleveraging Process

“Leverage” means borrowing funds for investment purposes. It creates short-term and long-term debt cycles. Short-term debt cycles typically last for 5–8 years.

Oct. 27 2015, Updated 1:04 a.m. ET

China’s leverage and associated debt cycles

“Leverage” means borrowing funds for investment purposes. Leverage creates short-term and long-term debt cycles.

Short-term debt cycles typically last for 5–8 years. Credit is readily available. This is the case in the Chinese economy. In China, the short-term external debt rose to $6833.6 billion in 2014 from $6766.3 billion in 2013. Long-term debt cycles last for 75–100 years. With every short-term debt cycle, spending and borrowing rise. At some point, debt rises faster than income. This is when deleveraging comes into the picture.

Why deleveraging is bad

Deleveraging is bad because it can force the economy to get trapped in a vicious cycle.

In deleveraging, individuals cut spending, income falls, unemployment rises, credit disappears, asset prices fall, the real estate market falls, banks get into trouble, and borrowers become less creditworthy. This severe economic contraction is called a “depression.”

China’s leverage is high. If it isn’t handled carefully, it can cripple the economy. China has already started deleveraging to reduce the mounting debt burden. With the weakening domestic and export demand in China, incomes are getting squeezed and debt repayments are rising.

Ways to tackle deleveraging

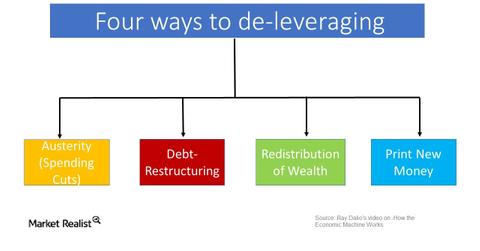

China’s government and the Central Bank should join hands to come out of the deleveraging situation. This can be done in four ways.

- Austerity – It’s also known as “spending cuts” by the government, businesses, and individuals. It’s painful and deflationary. Debt could rise due to lower income.

- Debt restructuring – Lenders get paid back less, get paid over a longer timeframe, or get paid at lower interest rates than initially agreed. It’s also painful and creates deflation.

- Redistribution of wealth – The government raises taxes on wealthy individuals. Over time, wealthy people get squeezed by the weak economy and higher taxes.

- Print new money – The Central Bank prints new money and uses it to buy government bonds. In turn, this allows the government to increase spending through its stimulus programs and unemployment benefits.

Impact on China-focused mutual funds

If deleveraging is tackled carefully, it can benefit the Chinese economy. It could have a positive impact on the China-focused mutual funds—the Clough China Fund – Class A (CHNAX), the Fidelity China Region Fund Class C (FHKCX), the John Hancock Greater China Opportunities Fund Class A (JCOAX), and the Matthews China Investor Class (MCHFX).

Consumer discretionary companies’ ADRs (American depositary receipts) like Jumei International (JMEI), Ctrip.com International (CTRP), Qunar Cayman Islands (QUNR), Tuniu (TOUR), and New Oriental Education (EDU) may have an adverse impact on revenue due to lower spending on travel, leisure, and luxury products.