What Drove Philip Morris’s Revenue in Q3 2018?

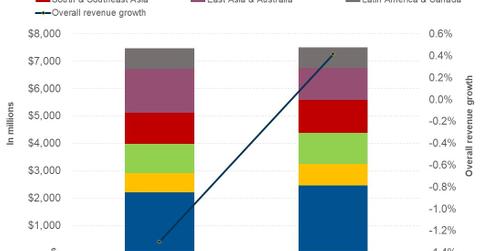

In the third quarter, Philip Morris International (PM) posted revenue of $7.50 billion, outperforming analysts’ expectation of $7.17 billion.

Aug. 18 2020, Updated 5:25 a.m. ET

Third-quarter revenue

In the third quarter, Philip Morris International (PM) posted revenue of $7.50 billion, outperforming analysts’ expectation of $7.17 billion. Year-over-year, the company’s revenue grew 0.4%. However, excluding unfavorable currency, the company’s revenue grew by 3.3% driven by favorable pricing of ~8.0% in the combustible products business, partially offset by a decline in total shipment volume of 2.1%. Excluding unfavorable estimated distributor inventory movements, the total shipment volume increased by 1.1%.

Performance across different regions

- European Union: The segment earned revenues of $2.47 billion, which represents YoY (year-over-year) growth of 11.9%. However, removing the impact of favorable currency, the company’s revenue increased 10.6% driven by favorable pricing variance primarily in Germany and Italy.

- Eastern Europe: The revenue from the segment rose 10.4% to $778 million during the quarter. Excluding unfavorable currency, the revenue from the region grew by 16.9% driven by favorable pricing variance in Russia and Ukraine and growth in shipment volume of heated tobacco units, partially offset by a decline in shipment volume of cigarettes. The shipment volume of cigarettes declined primarily in Russia and Ukraine due to the implementation of excise tax and growth in illicit trade.

- Middle East & Africa: The revenue from the segment increased by 6.0% to $1.14 billion. However, excluding the impact of unfavorable currency, the revenue from the region increased by 15.0% driven by favorable pricing variance, primarily in Egypt and Turkey, and an increase in total shipment volume of 3.3%.

- South & Southeast Asia: The revenue from the segment increased by 6.0% to $1.20 billion. Excluding the impact of unfavorable currency, the region’s revenue grew by 13.2% driven by favorable pricing variance, primarily in Indonesia and the Philippines, and an increase in cigarette shipment volume of 2.5%.

- East Asia & Australia: During the quarter, the revenue from the region declined by 27.2% to $1.17 billion. Excluding the impact of currency, the revenue from the region fell by 27.2% due to a decline in total shipment volume of 22.3%, partially offset by favorable pricing variance. The shipment volume of heated tobacco units declined due to net unfavorable estimated distributor inventory movements in Japan.

- Latin America & Canada: The revenue from the segment declined by 0.4% to $753 million. However, removing the impact of currency, the company’s revenue increased by 2.9% driven by favorable pricing variance, partially offset by a decline in total shipment volume of 3.9%.

Peer comparisons

During the same period, analysts expect Altria Group (MO) to post revenue of $5.21 billion, which represents growth of 1.8% from $5.12 billion in the corresponding quarter of the previous year. Next, we’ll look at analysts’ revenue expectations for the next four quarters.