The Importance of Diversified End Market Exposure

Steel companies’ product portfolios and end market exposures can have significant impacts on company performance.

Sept. 28 2015, Published 11:47 a.m. ET

End market exposure

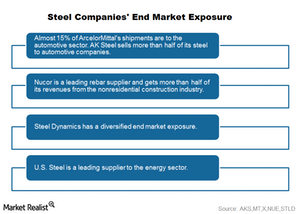

There are several grades of steel products, each with its own unique end usage. Steel companies’ product portfolios and end market exposures can have significant impacts on company performance. In this part, we’ll look at a comparative analysis of different steel companies based on these metrics.

Automotive sector

Almost 15% of ArcelorMittal’s (MT) steel shipments are to the automotive sector. For AK Steel (AKS), the ratio is even higher at ~50%. These companies’ higher automotive shipments expose them to the auto industry’s health. Vehicle sales have been strong in the United States as well as in Europe over the last couple of years. This has led to higher shipments for both AK Steel and ArcelorMittal.

However, according to some analysts, vehicle sales in the United States (DIA) could be losing steam. This would have a negative impact on companies like AK Steel.

U.S. Steel Corporation (X) has substantial exposure to the energy sector. The company was the leading supplier of tubular products in North America. However, its tubular shipments have fallen in recent quarters, as we’ll explore in the next part of the series.

Construction industry

Nucor (NUE) is a leading supplier to the nonresidential construction industry. The company is the largest rebar supplier in North America. Nucor stands to benefit from rising nonresidential construction spending.

Meanwhile, Nucor has ~10% exposure to the energy sector. Steel demand from the energy sector has been subdued due to a cut in energy companies’ capital expenditures. However, Nucor’s automotive shipments have risen over the last couple of quarters as the company has gained market share in that space.

Steel Dynamics has diversified exposure

Steel Dynamics (STLD) is among the most diversified steel companies in terms of end market exposure. In 2014, the construction sector accounted for ~35% of the company’s steel shipments. On the other hand, the energy sector accounted for only about 4% of its shipments. Nevertheless, Steel Dynamics’s energy exposure has risen following its Columbus acquisition.