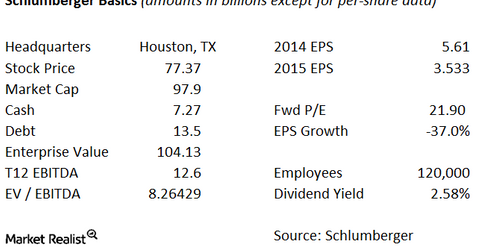

Basics of Schlumberger

Schlumberger (SLB) provides technology, project management, and information technology services to the oil and natural gas exploration and production industry.

Sept. 29 2015, Updated 9:04 a.m. ET

Schlumberger—a major oil services company

Schlumberger (SLB) provides technology, project management, and information technology services to the oil and natural gas exploration and production industry. Schlumberger manages its business through three groups: Reservoir Characterization, Drilling, and Production. Each group consists of a number of service and product lines, which company refers to as Technologies.

You can think of each group as a stage of the energy production cycle. The Reservoir Characterization Group is involved with the seismic analysis used to detect and measure potential oil and gas reservoirs. The Drilling Group is involved with positioning and drilling the well, and the Production Group is involved with the lifetime of the well.

Reservoir Characterization Group: This group is involved in the exploration phase. The service lines in this group include WesternGeco, Wireline, Testing Services, Schlumberger Information Solutions, and Petrotechnical Services. WesternGeco and Petrotechnical Services are used for seismic exploration and analysis. Reservoir Characterization accounted for about 25% of 2014 revenues.

Drilling Group: This segment is involved with the positioning and the drilling of wells. The technologies in this group include Bits & Advanced Technologies, M-I SWACO, Geoservices, Drilling & Measurements, Drilling Tools & Remedial, Saxon Rig Services, and Integrated Project Management well construction projects.

Production Group: This group takes over once the well is up and running. It includes Well Services, Completions, Artificial Lift, Well Intervention, Water Services, and Schlumberger Production Management field production projects. This segment also includes the joint venture OneSubsea with Cameron (CAM). Cameron owns 60%, and Schlumberger owns 40%.