How an Economic Cycle Can Impact Mutual Funds

All that goes up must come down. And this applies to economic cycles as well. No boom lasts forever, and all economies experience a slowdown.

Sept. 24 2015, Published 4:22 p.m. ET

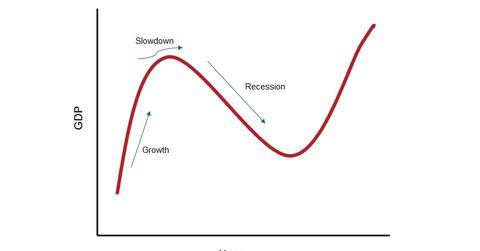

Economic cycle

Economies of all nations go through a cycle. This economic cycle fluctuates between an economy witnessing growth and going through recessions. A look at the graph below will give you a basic idea about an economic cycle.

An economic expansion, whose rapid version is called an economic boom, is associated with economic growth that’s faster than a country’s potential growth. Signals of an economy in rapid expansion include a falling rate of unemployment and high real wages. These lead to a higher disposable income in the hands of more people.

The result is a surge in household, or consumer, spending with demand of goods rising across the spectrum, from FMCG (fast moving consumer goods) to autos and real estate. Good times for regional and national companies like Casey’s General Stores (CASY), Burlington Stores (BURL), and Advance Auto Parts (AAP).

Apart from consumer spending, business investment also picks up as companies expand their operations due to higher demand. This further pushes the unemployment rate down, and due to wider job opportunities, workers are in a better position to negotiate wages, thus leading to a further rise in real wages.

Credit is abound as banks are willing to lend to consumers and businesses alike.

All that goes up…

All that goes up must come down. And this applies to economic cycles as well. No boom lasts forever, and all economies experience a slowdown. In a slowdown, while an economy continues to rise, its pace slows.

If available credit, which out-volumes real money, dries up further due to an overly rapid growth that leads to an unrealistic rise in asset prices, it can lead an economy into a state known as a recession. Unlike a slowdown, a recession sees a fall in economic output and is signaled by the reverse of everything that’s associated with an expansion, or a boom.

How are mutual funds impacted?

Stock market mutual funds focused on a particular geography, like the Hennessy Japan Investor ETF (HJPNX) or the Columbia European Equity Fund – Class A (AXEAX), can behave a bit differently than direct equities and ETFs.

Mutual fund houses generally adopt a bottom-up approach to investing. That is, they focus more on individual stocks than on specific industries or a geography as a whole. It’s important to know, though, that some fund managers do look at macro factors as well before constructing a portfolio.

Due to their active nature, timely ahead-of-the-curve investment decisions by portfolio managers can lead to them selling off their holdings in case of an impending recession and hold cash in their portfolio until they find conditions good enough to invest again.

Before moving to specific examples, let’s first look at the importance of spending to an economy, using the example of the United States.