The Challenges Affecting Lululemon Athletica’s Cost Structure

Lululemon Athletica (LULU) reported a 5.2% rise in gross profit to $205.9 million in 1Q16. The increase in profits was driven by higher sales.

Sept. 11 2015, Updated 7:06 a.m. ET

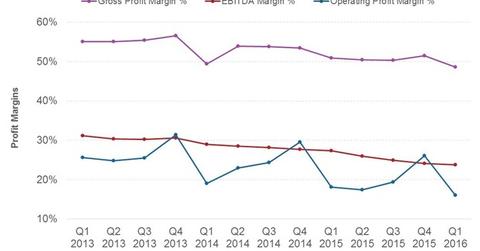

Analyzing profitability margins for Lululemon Athletica

Lululemon Athletica (LULU) reported a 5.2% rise in gross profit to $205.9 million in 1Q16. The increase in profits was driven by higher sales, as we described earlier in this series.

However, the “athleisurewear” maker’s profitability fell, partly due to external factors and partly due to internal measures that the company’s implementing.

- Gross margin fell from 50.9% in 1Q15 to 48.6% in 1Q16.

- Operating margin declined from 18.1% in 1Q15 to 16.1% in 1Q16.

Cost pressures

The company is in the midst of aggressively expanding its store footprint outside Canada—in the United States, Europe, and Asia. It’s also revamping its go-to-market calendar and looking for improvements in the supply chain. These and other factors led to the company’s margins deleveraging.

- The higher US dollar decreased margins by 0.7%.

- Higher occupancy and other costs, fueled by store expansion, affected margins by 1.3%

- Investments in supply chain and productivity enhancements affected profitability by 0.3%.

- Lululemon incurred higher freight costs in 1Q16 for transporting goods due to the West Coast ports issue. Margins declined by 1% due to this problem.

However, margin pressures were somewhat mitigated by the product mix tilt towards a pricier sell-through. This change improved margins by 1%.

Peer group comparisons

That being said, gross margins for LULU, at 50.3% over the trailing 12 months, are healthier than peers’.

- Nike (NKE) clocked in 45.8%.

- Under Armour (UA) earned a gross margin of 48.8%.

- VF Corporation’s (VFC) gross margin came in at 48.7%.

LULU’s higher percentage of direct-to-consumer sales, vertically integrated model, and pricier products help keep its margins higher.

Other retailers (XRT) Zumiez (ZUMZ) and L Brands (LB) earned 35.4% and 41.9%, respectively, in their last fiscal years. ZUMZ and LB compete with LULU in selected segments.

Outlook

In 2Q16, Lululemon’s margins are likely to be affected by a product recall, as we discussed in Part 2. The higher US dollar is also likely to remain a headwind, although not to the same extent as peers Nike (NKE) and VF Corporation (VFC). Higher occupancy costs associated with store rollouts are also likely to continue affecting the bottom line. The company’s also likely to experience mark-downs on a portion of its inventory due to the West Coast ports issue.