Drivers for Ericsson’s Managed Services Business Revenues

In the first nine months of fiscal 2017, Ericsson’s Managed Services business generated revenues of ~18.3 billion SEK (Swedish kronor), which is equivalent to ~$2.1 billion.

Jan. 23 2018, Updated 7:33 a.m. ET

Managed Services segment

Ericsson’s (ERIC) Managed Services offer solutions in three areas—IT, Networks, and Network Design and Optimization.

According to Ericsson’s December 8, 2017, press release, “Managed services for networks range from hands-on field service operations to remote network operations. IT managed services include the management of applications and data centers, while network design & optimization services evolve and expand customer networks to meet ever-changing demands from consumers and business users.”

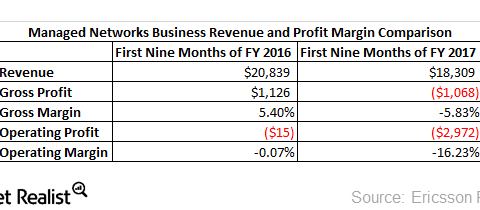

In the first nine months of fiscal 2017, Ericsson’s Managed Services business generated revenues of ~18.3 billion SEK (Swedish kronor), which is equivalent to ~$2.1 billion. This business generated revenues of ~20.8 billion SEK (or ~$2.4 billion), indicating a YoY (year-over-year) fall of 12.3%.

Profit margins

Ericsson’s gross margin fell from 5.4% in 9M16 to -5.8% in 9M17. Its operating margin fell significantly from -0.07% to -16.0% during the same timeframe.

Service contracts with global operators

Ericsson expects its revenues to grow at a CAGR[1. compound annual growth rate] of 2.0%–4.0% between 2016 and 2020. To drive long-term revenues, Ericsson aims to secure three- to seven-year contracts with high renewal rates.

Currently, Ericsson has this type of contract with Sprint (S), Vodafone (VOD), T-Mobile (TMUS), France Telecom, and India’s (INDA) Bharti Airtel.