Why Under Armour Unveiled a Blueprint for International Expansion

Under Armour’s (UA) international operations are among its fastest-growing businesses.

Oct. 14 2015, Updated 8:04 a.m. ET

Analyzing the growth drivers in Under Armour’s overseas operations

Under Armour’s (UA) international operations are among its fastest-growing businesses. At the 2015 Investor Day presentation, UA management provided an update on its overseas strategy and expected performance over 2014–18.

International sales projections

Last year, UA increased international sales by 92% year-over-year. The company is projecting its overseas revenue to grow about fivefold by 2018, a CAGR[1. compound annual growth rate] of ~50% over 2014–18. That would take the business from $270 million in sales in 2014 to $1.35 billion by 2018. The contribution to overall sales would double, from 9% in 2014 to 18% by 2018.

In contrast, peers Nike (NKE) Lululemon Athletica (LULU), and VF Corporation (VFC), derived over 55%, 38%, and 30% of their respective revenue from outside the United States in their last fiscal years.

Store footprint

Under Armour is embarking on an aggressive expansion program outside the United States. It’s planning to have operations in over 40 countries by 2018, taking its tally of international locations to over 800. By the end of 2018, 80% of its global door count would be located outside of the United States, up from 38% presently. Most of the new doors would come via partnerships with distributors, especially in China, Japan, and Korea. UA expects to own and operate only about 30% of the total number of locations worldwide, or about 300.

UA is also planning to have 2,000 shops-in-shops in wholesaler-operated stores. The company recently signed a partnership with SportScheck, Germany’s largest sporting goods retailer.

Premium strategy

According to Charlie Maurath, UA’s President of International, the company plans on a premium positioning in each of the overseas markets it enters—whether through wholesalers or through company-owned and operated retail stores or store presence via a partnership.

UA also plans on 30 country-specific e-commerce sites, which should boost both international and e-commerce sales (XLY).

International sponsorships

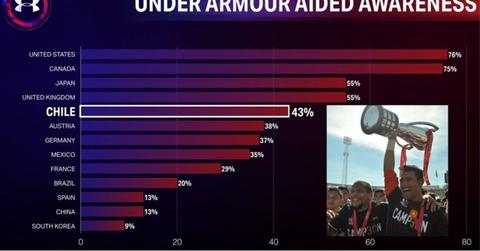

UA’s been signing sponsorship deals with sports clubs in Europe and Latin America, like São Paulo in Brazil, the Welsh Rugby Union, German football club FC St. Pauli, Austria’s ski team, and the Tottenham Hotspurs. It’s also been signing on international athletes like Manchester United’s Memphis Depay, a couple of skiing stars in the Austrian Ski Team, and Andy Murray in order to drive more local followers.

While UA may lack the deep pockets of Nike (NKE) or Adidas (ADDYY) to go after the larger superstars in the athletic world, these investments are strategic and designed to give the best returns in the geography and sports category UA’s targeting. Some of UA’s really successful sponsorship investments—like Jordan Spieth in golf and Stephen Curry in basketball—have generated a tremendous level of exposure for UA, boosting the sporting category and the UA brand overall.