Widening High-Yield Bond Spreads: Opportunity or Threat?

Investors should note that high-yield bonds are risky securities to begin with. The add-on risk of widening spreads may not suit all types of investors.

Aug. 27 2015, Published 1:04 p.m. ET

What are high-yield bonds?

High-yield bonds are corporate debt instruments that are rated BB or below by Standard & Poor’s or Ba or below by Moody’s. High-yield bonds are also known as junk bonds.

ETFs such as the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and the SPDR Barclays High Yield Bond ETF (JNK) help you invest in junk bonds. HYG invests in junk bonds of companies such as HCA Holdings (HCA), T-Mobile US (TMUS), and Navient (NAVI).

High-yield bond yields

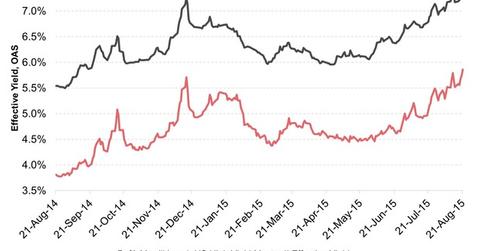

For assessing the movement of high-yield bond yields, we’ll use the BofA Merrill Lynch U.S. High Yield Master II Effective Yield. The above graph shows that yields according to this measure have nearly uniformly risen, especially since February 2015. At their present level, they’ve even crossed the previous peak on December 16, 2014. On August 21, 2015, yields by this measure stood at 7.38%, the highest since June 30, 2012.

Spreads in 2015

The BofA Merrill Lynch U.S. High Yield Master II Option-Adjusted Spread (or OAS) measures the average difference in yields between dollar-denominated junk bonds issued in the United States and Treasury securities.

In 2014, spreads by this measure ranged between 3.35% and 5.71%. They widened as the year went on. In 2015, until August 21, spreads have ranged between 4.38% and 5.86%. Spreads fell to their lowest level for 2015 in early March. However, at present, spreads according to the above measure stand at 5.86%, the widest since November 16, 2012. Going back to 2008 shows that in mid-December 2008, spreads widened to 21.82%, or 2,182 basis points.

Currently, a widening spread shows that credit conditions have worsened since March 2015. Wide spreads make a risky security attractive due to its cheap price. However, investors should note that high-yield bonds are risky securities to begin with. The add-on risk of widening spreads may not suit all types of investors.

A rise in high-yield bond yields has also impacted junk bond issuance. Let’s look at that in the next article.